Embracing Emergence Update

If you haven’t seen the new EE website, you can see that I’ve given the newsletter a new look to reflect the journalistic path I have been pursuing lately.

The hope is to keep interviewing the best LPs and GPs and to provide a unique window that give more transparent insight into what these 1:1 conversations are actually like.

Also, I want to feature Emerging Managers who have successfully closed their fundraise. This can function as part of their fundraising announcement, while also sharing: what worked, what didn’t, and how did you raise in this environment?

One of these volumes will come out end of July / early August!

If you want to be featured, please reach out to me here.

Embracing Fund+ with Sydecar - A Mini-Series on setting up your fund

Sydecar is the go-to platform for emerging VCs to manage both their SPVs and funds.

Setting up your fund, fund legal docs, managing compliance, KYC, LP-onboarding, capital calls, and tax documents is not sexy. And having a solid backend and fund admin is nothing that differentiates you. However, having a bad set-up is something that differentiates you… towards the negative.

A big reason why I love partnering with Sydecar is because they provide a huge offering to Emerging Managers for all the things GPs should not be spending a huge amount of time on.

With Sydecar’s Fund+ product Emerging Managers get end-to-end fund formation and fund administration. I did a demo of the product myself, both from the perspective of a GP and LP.

Fund+ covers banking, your legal documents, contracts, tax, reporting, LP-onboarding, KYC, capital calls, co-investments through integrated SPVs, etc. AND it’s more cost-effective!

And for me as a LP, I have a simple onboarding form, can see my capital calls, commitments, and financials - everything I want to see, no hassle.

I will be covering more about Fund+ in the next volumes, since I have been talking with several GPs who are looking for a trustworthy fund admin platform, that simplifies the complex process of setting up and running your fund without compromising on sophistication.

Click here to learn more about Fund+ and take a self-guided tour of the product. .

Volume #31 TL;DR:

All work and no play makes Jack a dull boy.

A large majority of LPs goes through the same process on a first call. At some point, the Emerging Manager will ask: “Would you mind if I share my screen and tell you more about my fund?” As they present, they encourage you to interrupt, but they’re in such a flow, that organic conversation doesn’t happen.

This process is empty of any play. There is no room to go back and forth. Get to know each other. Learn about the other person. Crack a joke. Refresh the soul.

As LPs, it’s part of our job to minimize this gap between the false and true self. One key way we actually get to do that is by encouraging play with the Emerging Manager.

Table of Contents

Thomas Aquinas and Aristotle on Fundraising

I have read more books from the BC timeframe than I have read business books from our modern time - I’m sure I’m missing out, but it’s what I’ve fallen in love with. Many of the insights of the past still hold true today - and if something has been true for 400+ years, there is a good chance it will remain true. It has stood the test of time.

I can say that I have learned a lot from the ancient thinkers on integrating business with my character and life. One example is Cicero’s Treatise on Friendship, which talks about the importance of meaningful relationships in our life. It has influenced how I approach GPs and fellow LPs.

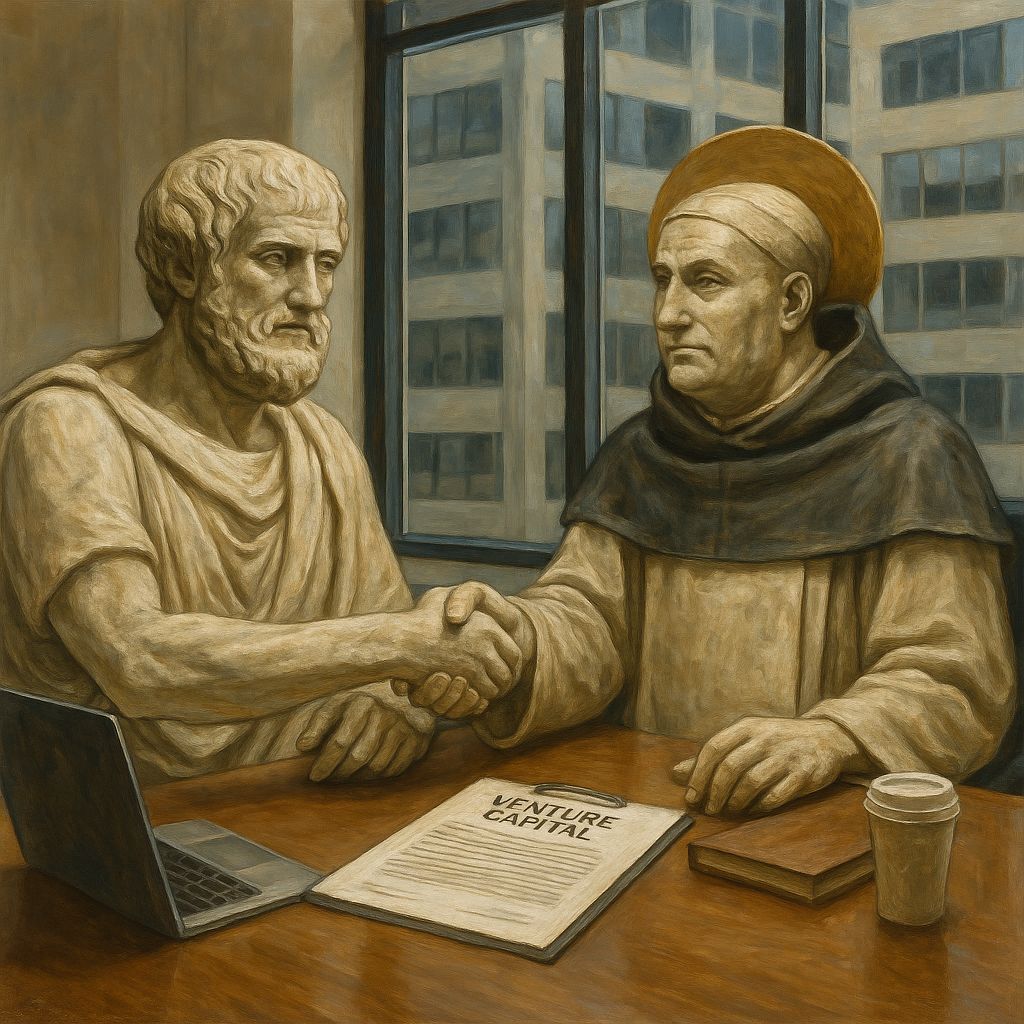

Thomas Aquinas becoming a LP in Aristotle’s Fund I

One of the things that great thinkers like Aristotle and Thomas Aquinas have written about is the virtue of play. I will lay out what this virtue means and looks like, but first of all want to make mention of the fact that they elevated “play” in our lives to the level of a virtue. Not simply as a good thing, but as something that we ought to have.

Similarly, I (not that I’m Aquinas), want to elevate “play” onto a virtue that we Limited Partner and Emerging Managers should integrate into our relationship and fundraising process.

The argument I want to make in this volume is that “play” will end up setting your relationships up in a way where GPs will raise more $ from Limited Partners than with their pitch deck.

It’s nothing novel to say that investing time into getting to the LP you’re speaking with will pay off more than focusing on your pitch deck. So, consider the virtue of play as some extra sauce on top of this recipe.

What is the Virtue of Play?

“All work and no play makes Jack a dull boy.”

All work and no play makes Jack a dull boy. The origin of this old proverb is not clear, but it first appeared in 1659, when the historian and writer James Howell included it in his comprehensive text “Proverbs in English, Italian, French and Spanish”.

This proverb refers to “eutrapelia”, a Greek term meaning “ready wit” or “pleasantness in conversation”. Aristotle was the one who included eutrapelia as one of his virtues - the golden balance between boorishness and buffoonery.

Likewise, Thomas Aquinas included eutrapelia, most likely based on Aristotle’s work, in his scheme of virtues as part of the temperance once ought to posses.

Thomas Aquinas explains that, “just as the body needs rest when it is weary, our soul also needs rest when it is overburdened. And, like the body, the soul takes rest in a kind of pleasure, which we call “play”.

This playfulness has its appropriate time, place, and mode. But if we use it well, we can speak of it as the virtue of play. Through games we restore the strength of our souls, so that we can be refreshed to pursue higher things… such has closing LPs.

Why Emerging Managers Need to Master the Virtue of Play

In one of my 1:1 LP interviews, which I publish in my LP-section on Embracing Emergence, I got to speak in depth about redesigning the LP Meeting with David Zhou.

David said the following:

“At the base level, I don’t think emerging managers are actually connecting with folks. They’re thinking transactionally: “You have money, I need money. What’s the fastest way I can get you to give me money?”

A large majority of LPs goes through the same process on a first call, typically a 30min Zoom call:

You start with pleasantries for the first 5min (at the least)

Then at some point, the Emerging Manager will ask: “Would you mind if I share my screen and tell you more about my fund?” As they present, they encourage you to interrupt, but they’re in such a flow, that organic conversation doesn’t happen.

You might have 5min left for questions.

This process is empty of any play. There is no room to go back and forth. Get to know each other. Learn about the other person. Crack a joke. Refresh the soul.

I know it’s the same for GPs, but us Limited Partners do these calls ALL THE TIME. It’s refreshing if we do not spend 15-20min to a monologue about your fund.

“You can discover more about a person in an hour of play than in a year of conversation.”

Also, Emerging Managers need to have mastered the virtue and skill of play, because the spectrum of people they need to be able to connect with is so unusually broad. Since, you’re not just an investor, you’re also a fund manager.

Emerging Managers need to be able to invite the engineer, the 2nd generation family office principal, the tech entrepreneur, the college drop-out, the insecure genius, etc. to play with them. This manifests itself in an instinctual behavior to build trust and care for other people.

I watch my young daughter try to initiate play with her friends all the time. Let’s say they want to play “house” together. This type of play takes more skill than what we see on the surface. You have to:

Extend the invite to play

Determine roles for the play that are interesting enough for your counterparty to agree to

Play in such a way that the play can continue and is enjoyable

Play in such a way that you get to extend the invite again in the future and repeat it

Why Limited Partners Need to Master the Virtue of Play

Why should LPs care about spending time in play when talking with prospective Emerging Managers?

Well, the answer is simple, if you’re waiting for a couple years to see any money back in your account after investing, you want to make sure you deeply understand who you’re investing in.

What you don’t want is to deeply understand the strategy and financial value proposition without the same level of depth of understanding that the Manager is the right person to actually execute the strategy and do what they say.

And as the psychologist Jung would suggest, people aren’t always who they say they are. We all tell ourselves and other people things about us that aren’t always true.

So, as LPs, it’s part of our job to minimize this gap between the false and true self. One key way we actually get to do that is by encouraging play with the Emerging Manager. And even if you don’t end up investing, you get insights that will help you understand the market and the people that are shaping it more deeply.