Embracing Emergence Is Partnering With Sydecar 🤝

Sydecar is the go-to platform for emerging VCs to manage both their SPVs and funds. They are on a mission to make private markets more accessible, transparent, and liquid by standardizing how investment vehicles are created and executed. Sydecar’s powerful software allows Emerging Managers to launch SPVs and funds instantly, track funding in realtime, and offer hassle-free opportunities for early liquidity.

Sydecar acts as the silent operating partner to Emerging Managers, handling all back-office functions in a single place. Say goodbye to chasing subscription docs, lost wires, or late K-1s. And for LPs, as an LP myself, I know how important it is to have an easy onboarding process, along with quarterly capital calls and tax docs, all managed by a trusted platform. Sydecar delivers on all fronts, ensuring both managers and investors have the support they need from a platform they can trust.

Click here to reach out to their team via the exclusive link for our community.

Volume #17 TL;DR:

It’s not that assessing Emerging Managers is just an art, but it’s also not just a science. Mastering Emerging Managers is a craft that requires mastering.

The key understanding is that the best interruptions are relational.

Growth is directly correlated to our willingness to face our inner demons.

The worst thing an investor can do is to tell themselves a narrative about themselves and their decision-making that is not true.

Table of Contents

Monks & Managers And How They Are More Alike Than We Think

In my last volume, I highlighted how Monks & Managers was an initial iteration around a potential Fund of Funds specifically focused on picking the best first-time Emerging Managers. This iteration was the beginning of Embracing Emergence.

I recommend reading the first volume for further context since this volume will be a continuation of why Emerging Managers and Monks share similar traits. My hope with me sharing my thoughts on this is to create a broader color palette of understanding Emerging Managers and performing due diligence.

It’s not that assessing Emerging Managers is just an art, but it’s also not just a science. Mastering Emerging Managers is a craft that requires mastering.

So, here is the overview I shared in my previous volume of the similarities between Managers & Monks, which I often reflect on when talking to EMs:

Managers, just like Monks, leave a life of comfort behind to pursue a calling.

Managers, just like Monks, are all sold out for their calling and pursue it radically.

Managers, just like Monks, pursue a role in society that is vital to ensure its continued flourishing.

Managers, just like Monks, foster education and the intellectual development of society.

Managers, just like Monks, gather people around them to create something bigger than themselves.

Managers, just like Monks, master the art of interruption (monks have a practice of being interrupted in their daily lives).

Managers, just like Monks, face being misunderstood.

Managers, just like Monks, ought to spend an unusual amount of time facing their inner demons.

Managers, just like Monks, are people of the desert more than they are people of the city.

Being a Gatherer

The best Emerging Managers, just like Monks, gather people around them - today, we call these communities. What I want to highlight here is that monasteries did not form as the goal of a monk, but often as a side product of their radical and intentional pursuit. They often attracted people around them or invited selected people to journey with them.

Likewise, the best Emerging Managers do not build a community around their fund as a goal, but as a side product. Bonhoeffer, a great German thinker said to this:

“Those who love their dream of a […] community more than they love the […] community itself become destroyers of that […] community even though their personal intentions may be ever so honest.”

A gathered community shows that something interesting is happening. That something is happening that is different. Something that is not happening in other places. Something that is transformational and worth being a part of.

To make this practical: A Fund 1 who does this very well is Omni Ventures (Simon Lancaster and Sabrina Paseman are the GPs) - this is an unsolicited shoutout. They have formed a group for Emerging Managers where they exchange transparent questions, feedback, learnings, etc. Or they host sessions with experts of relevant topics to EMs for fellow peers. They also help LPs build meaningful relationships between each other.

Mastering Interruption

This one is a fun one and my wife taught me this about monks. Many monasteries have a bell within their facility that can be wrung at random points of time during the day. Whenever the sound of the bell is heard, monks ought to stop what they are working on and pray. This practice of interruption teaches them to always stay focused on the main element of their life and to not get caught up in the details of their days.

The practical equivalent to this is: taking a random phone call vs. only structuring your meetings with a Calendly link…

The more allegorical way of expressing this principle is by showing that the interruption of the monks was always focused on the core relationship that was valuable to their life.

So the key to understand is that the best interruptions are relational. I do not mean the interruption of a pop-up notification from X or LinkedIn. I mean an unplanned 2min phone call from somebody I am close to (thanks for the random 5min phone call this week Mark!).

I believe if you do not recurringly experience random phone calls from founders, LPs, or other relationships that are valuable to your fund, you most likely are not a 1% Emerging Manager.

Now, it is one thing to get interrupted, it is another to master it. And I believe “mastering” is the crux of the Emerging Manager and LP story. We are all on a path of mastery in our own way. Mastering interruption is embracing the discomfort and annoyance it can bring. It is turning my presence towards something different than what I had planned - no matter the outcome.

Being Misunderstood

Being misunderstood is the ONLY path in Venture Capital. It is the base assumption of what we are doing. You have to be right and non-consensus. And being non-consensus and being misunderstood go hand in hand. They’re not both apples, but one is an apple, the other is apple sauce.

Accepting that being misunderstood is the only path is even better than accepting that rejection is part of the journey. The likelihood to run out of energy to accept being rejected is given - we are human. But being convinced that your non-consensus journey is the right one is the definition of Venture Capital.

One of my best friends is actually in the process of becoming a monk. And the journey is everything else but “receiving affirmation from everybody”. It does not make sense to a lot of people.

Similarly, embarking on the journey of being an Emerging Manager and then also pitching your strategy to LPs as a fund that is still emerging, is a recipe for being misunderstood.

That is why both Emerging Managers and Monks are people of the desert.

Facing Your Inner Demons

In the Christian Old Testament, there is a story of the Israelites, who have fled from their captivity in Egypt and into the desert to journey towards the Promised Land. On their journey, due to their repeated doubt of, God sends snakes into their camp. The snakes are poisonous and bite the Israelites and turn into a serious threat to the people.

So, the Israelites turn to Moses and ask him to pray to God to take the snakes away. God responds to Moses and tells him to make a cast of a snake, put it on the top of a rod, and place it in the camp. Every person, who got bit and who looks at the snake that’s lifted up, will be healed.

I mention this story, because this is the foundation of Western psychology and what facing your inner demons means: look at the thing that you are afraid of, the thing that is poisoning you, and you will be healed. Growth is directly correlated to our willingness to face our inner demons.

The monastic life is very much so an intentional turning to our demons. It is an awareness of the fact that more peace and fullness and growth await those who overcome their inner demons.

I do not want to overspiritualize the journey of the Emerging Manager. But at the same time, I acknowledge that being an Emerging Manager is to some degree a spiritual journey. It is one that makes avoidance of our own weaknesses and insecurities detrimental, and the facing of it a superpower.

I have asked EMs about their insecurites, about their upbringing, etc. Why? Not to find right or wrong answers, but to get a sense of their willingness to be brutally honest with themselves. The worst thing an investor can do is to tell themselves a narrative about themselves and their decision-making that is not true.

The worst thing an investor can do is to tell themselves a narrative about themselves and their decision-making that is not true.

The People of The Desert

The people of the desert are communal, seek out space for reflection and contemplation, they leave behind the status quo, they build something that is bigger than themselves, they journey more than they are settled, they embrace discomfort, and they live more from their conviction that from the opinion of others.

I think as LPs we still have a lot to learn about fully understanding the journey of the best Emerging Managers we come across. And I also believe we have yet to fully embrace the kind of due diligence we can truly perform on Emerging Managers. The facets to assess when investing in Emerging Managers are rich and there are plenty of factors to consider. Some are more “science” than “art” and some are more “art” than “science”. But what I was hoping to make clear with these two volumes on Monks & Managers is that LPs have a craft that we ought to master.

Tools To Be A Monk

The reason I partner with Sydecar is that this newsletter can go beyond (hopefully) being insightful or refreshing to read. I want to provide tools just as much as I want to provide thoughts.

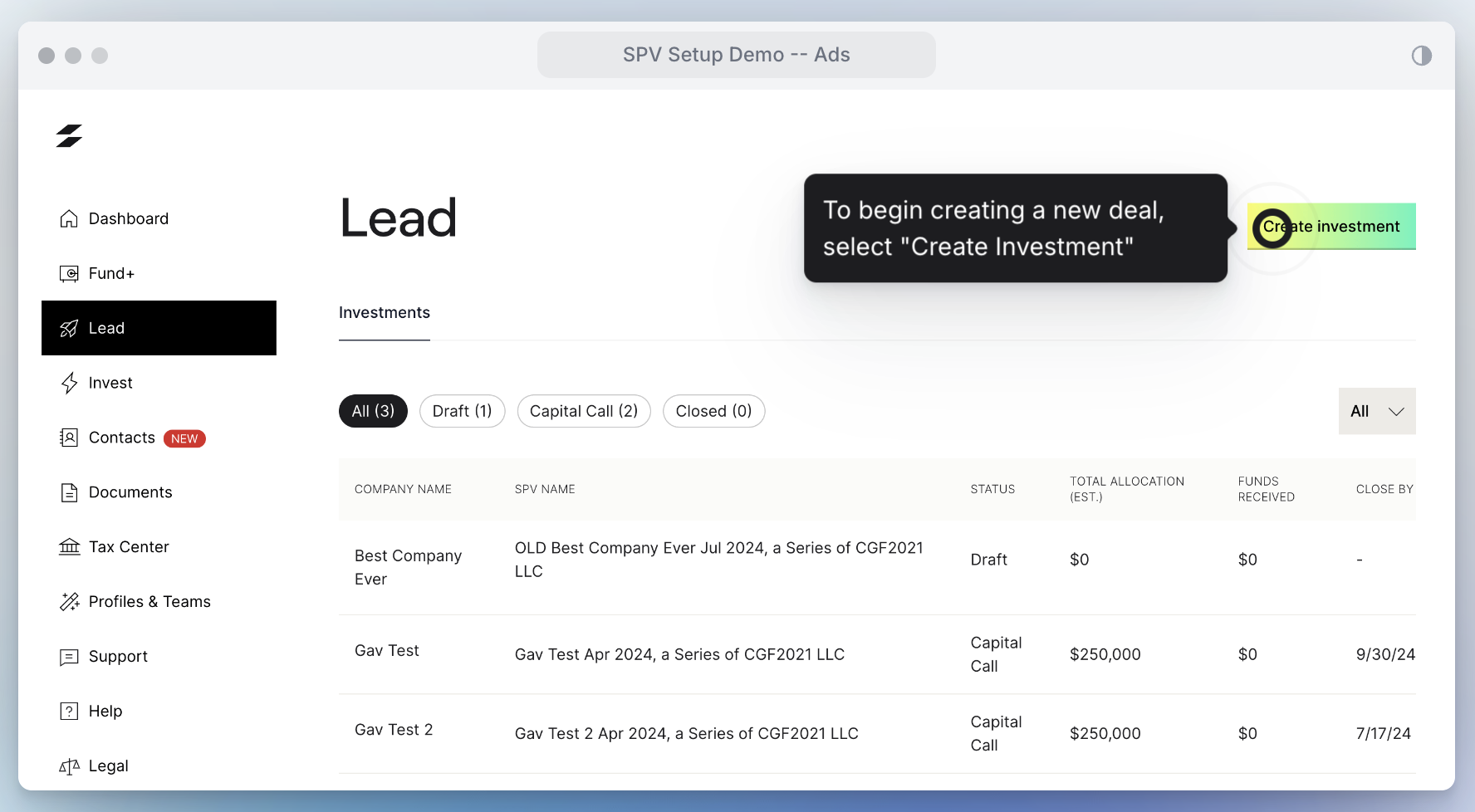

Sydecar launched a Syndicate product that enables Managers to practice these monastic elements in their operations. The product strengthens the Manager’s ability to build community, provide insights and learnings to people, and provide an engaging place for those who want to journey together!

You can experience Sydecar’s Syndicate platform in action through the exclusive interactive link below ⤵️ Their interactive demo walks you through how this powerful tool can streamline your syndicate operations, from setting up your first syndicate on the platform to handling investor communications, all in one intuitive place. Whether you’re handling a single SPV or managing multiple syndicates, their platform is designed to save you time, reduce complexity, and help you focus on sourcing and closing more deals. Check out the demo here:

Coming Up Next

I’m very excited to welcome another guest author to Embracing Emergence in the next volume. I have been writing and sharing a lot about the importance for Emerging Managers to lean more into the name for their fund and embrace linguistic consistency.

I asked my good friend Mark Scianna, who is one of the best first-time managers I know, to share more about the story that led to his fund and the name he chose to represent his thesis and fund approach. I was able to read what the next volume will look like and am very excited for him to share next time!!!