Generally speaking, I underwrite four aspects of any Emerging Manager: The manager(s), the strategy, the track record, and the fund operations.

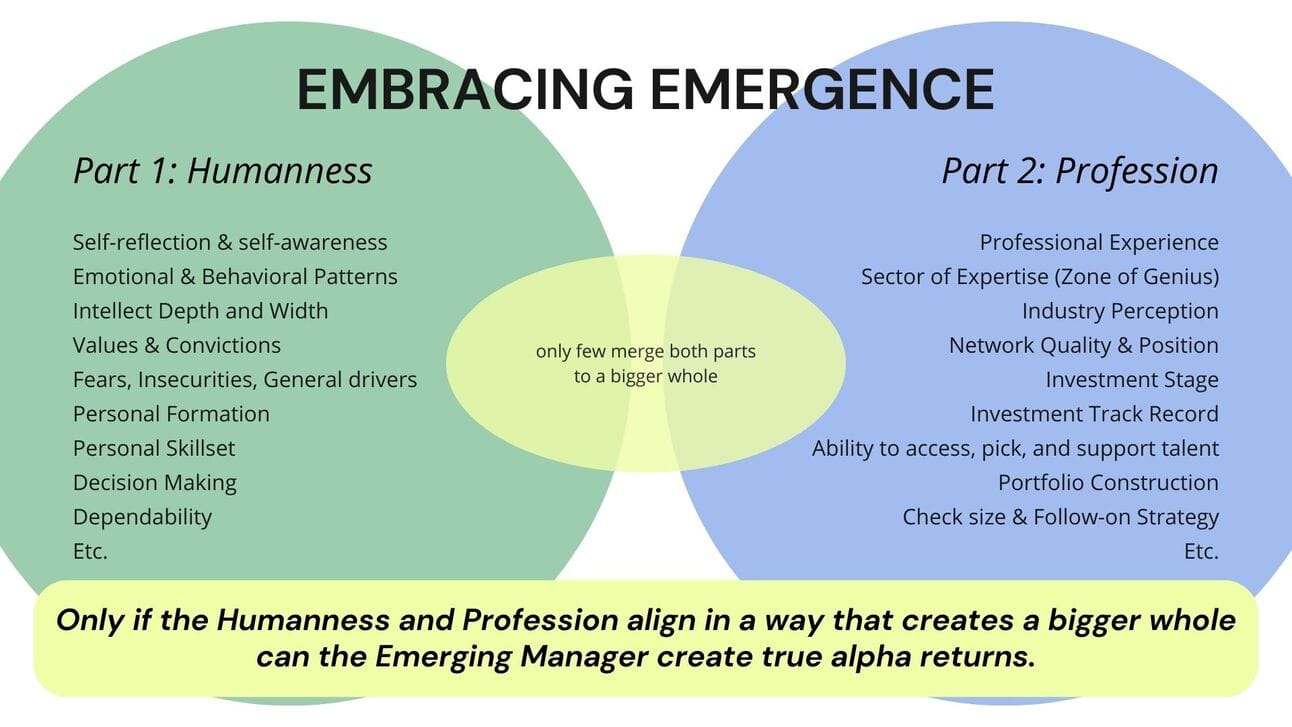

Today we continue to dive into the first aspect ‘The Manager(s)’, which can be split between what I call ‘Humanness’ and ‘Profession’. In the last volume we dove into what can be categorized under ‘Humanness’, today we dive into underwriting the ‘Profession’ element.

Interested in investing in the best Emerging Managers? Email me by clicking the button below and we can exchange insights! I always enjoy making introductions to the best Emerging Managers in my network.

Volume #5 TL;DR:

Emerging Managers and other Limited Partners joining as co-authors in the next weeks.

LPs need to Gain an understanding of who the Emerging Manager is as a person & gain an understanding of how the Emerging Manager underwrites founders.

The Humanness and Profession of the GP should exponentially enhance each other, not solely add value to each other linearly.

Humanness and Profession need to enhance the fund strategy exponentially.

‘Profession’ should be defined as: “The competence, work experience, and position of the Emerging Manager in a specific industry or sector.”

Table of Contents

A Quick Update

As many of you know, after working in Venture with a Family Office full-time for the past years, I have been spending the last months working full-time in Treasury and doing most of my work in VC on nights and weekends.

Not a day goes by without talking with Emerging Managers or LPs, connecting people in my network, learning, reflecting, and writing about what I believe is worth saying. It’s my obsession and worth every long night.

I’m writing this volume today while putting together the bassinet and several other things (I forgot how much it is 😀) for baby #2, who will be joining my wife, daughter, and me within the next 5 weeks. This means that the long nights will be filled with spending time with my son for the first days, which I could not be more excited about!

I hope for Embracing Emergence to become much bigger than myself, so I thought this would be a great opportunity to enrich what Embracing Emergence is becoming by inviting guest authors to write about their experiences, thoughts, and approaches in the GP-LP world.

I am currently lining up one person each to share from the Emerging Manager and the Limited Partner’s perspective. I’m super excited to share more and believe this will add a lot to the conversation this newsletter is hosting between GPs and LPS!

The Manager(s): Humanness & Profession

The Manager(s)

The Strategy

The Track Record

Fund Operations

The Manager(s):

It is my philosophy that LPs underwrite people who underwrite people. With this in mind, the goal of the due diligence process for Limited Partners needs to be:

Gain an understanding of who the Emerging Manager is as a person (see Volume #4).

Gain an understanding of how the Emerging Manager underwrites founders.

The who and the how ultimately need to align in such a way that the Limited Partner can gain clarity that the particular Emerging Manager is the right person for the investment strategy. There are times when the Emerging Manager is not the right person for a great strategy or times when the strategy is not in alignment with a great Emerging Manager.

LPs should only invest when they see a clear alignment between person and strategy because only then can outsized returns be created.

A “Formula” of Alignment

When it comes to understanding who an Emerging Manager is as a person, what makes them tick, and understanding their level of competence and expertise, I assess two parts I call: ‘Humanness’ and ‘Profession’.

I also believe that both parts should exponentially enhance each other, not solely add value to each other linearly.

Further, the Humanness and Profession need to enhance the fund strategy exponentially. It should look like this:

(Humanness*Profession) * Strategy = Desired Returns

Elements of ‘Profession’

In volume #4 I dove deeper into the Elements of ‘Humaness’ and how it should be defined. Humanness describes the personhood of the Emerging Manager, what shapes their thinking, behavior, and approach to life and people.

I define ‘Profession’ as such: The competence, work experience, and position of the Emerging Manager in a specific industry or sector.

Competence & Work Experience:

When assessing competence it is critical to be able to discern between confidence and competence. Of course, the Emerging Manager needs to be confident for a variety of different reasons, but confidence should not make up for a lack of competence. Limited Partners need to do their homework here and critically assess the competence of the Emerging Manager through their conversations with the GP, by studying their resume, doing reference checks, reading articles from the GP, listening to podcasts with the GP, and gaining understanding from founders on what competence they see as critical for a GP to bring to the table. You will get different answers, but you will start getting a “flavor” of what type of competence is needed.

It is important to note that the value created by the EM’s competence and work experience can look different every time. Depending on what stage, what industry, and what founders the GP invests in, different elements are more important than others.

Types of competence and experience LPs should generally look for in GPs:

Operational experience, especially as it relates to building early-stage companies.

Technical expertise, especially when investing in sectors like DeepTech or DefenseTech.

General competence in stewarding a wide variety of people and talents.

Product development-related experience.

Sales, etc.

The Position:

Part of the professional experience and competence should have led the Emerging Manager to a place where they are perceived as a key person within the industry they invest in. This perception should be shared by co-investors, follow-on investors, founders, strategics, etc.

The position should enable the Emerging Manager to get access to highly competitive deals early and at the best price possible. Ideally also with the motivation of the founder to want the GP on their side to add value in terms of setting them up for funding by adding operational or technical value and bringing other investors into the conversation. Any human-related value is covered by their ‘Humanness’ that should provide the right guidance to founders.

Summary

As mentioned assessing the Manager(s), which includes the parts of ‘Humanness’ and ‘Profession’ is just one part I underwrite. Investing in Emerging Managers is a craft made up of several different elements.

But I hope I can start to highlight that a wholistic approach will prove to be the most fruitful path for both LPs and GPs.

I will conclude with a quote from ‘The Prince’ from the 15th century:

Men in general judge by their eyes rather than by their hands; because everyone is in a position to watch, few are in a position to come in close touch with you. Everyone sees what you appear to be, few experience what you really are.

Know somebody, who would be interested in joining the Embracing Emergence community? Please feel free to forward this email!

Other Beehiiv newsletters I enjoy reading: