Sydecar's Newest Report is the Emerging Manager's Benchmark for SPV Fees

Sydecar recently published a great piece on how Emerging Managers are structuring fees for their SPVs. Here are the takeaways:

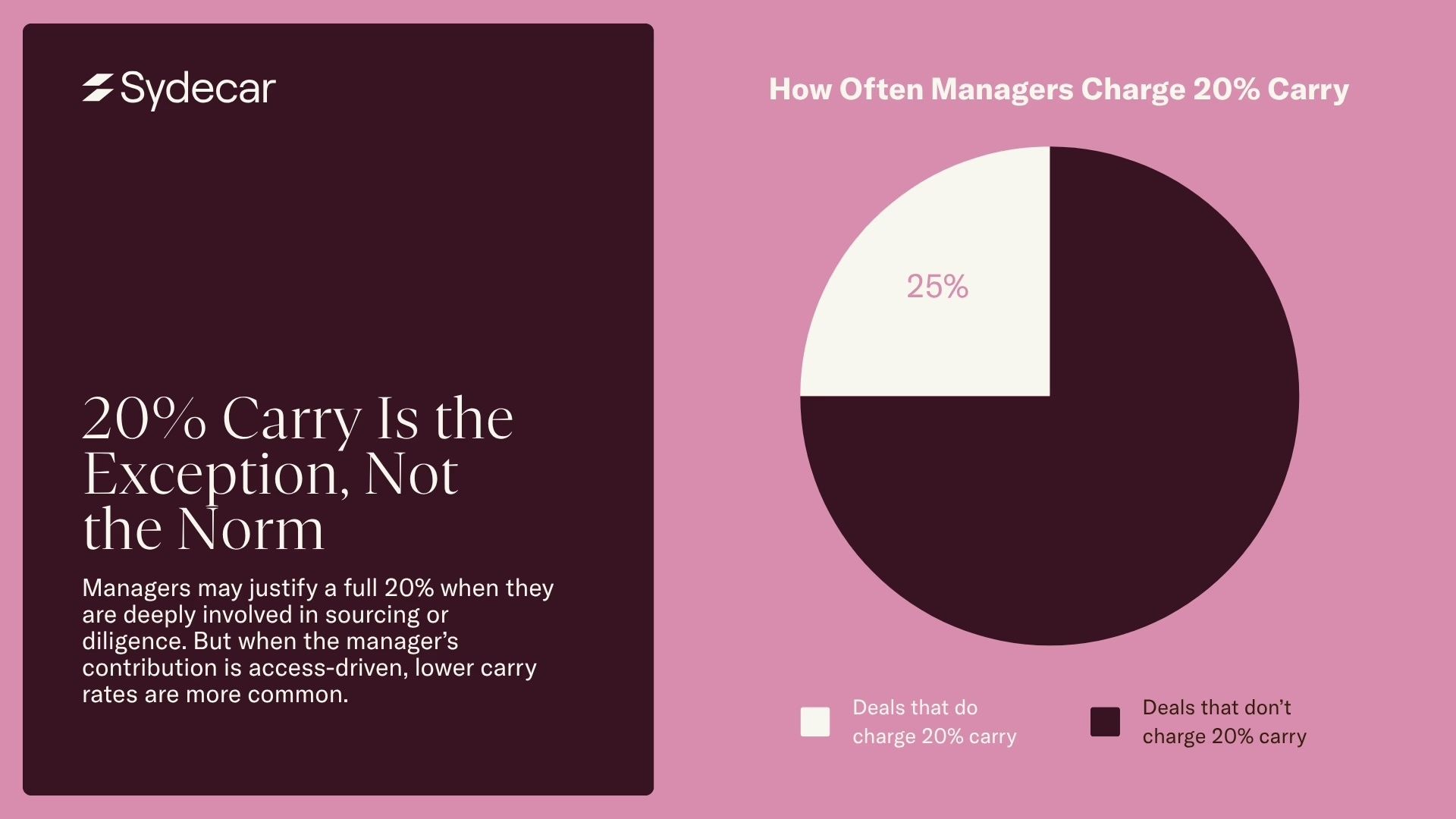

“2 and 20” has historically been the default structure for funds, however, there is no equivalent rule of thumb for SPVs, and terms have historically been more flexible.

Management fees show up in 53% of SPVs, with 2% as the most common rate. 80% of fees are collected up-front.

Carry is where the real remix happens. Average carry is 12%, median 15%, and only ~25% of SPVs charge 20%.

Secondaries are even more customized than direct deals (2 and 20 shows up 46% in direct vs 28% in secondaries).

Many Emerging Managers integrate SPVs into their investment approach for co-investment opportunities for their LPs and to extend their check sizes.

SPVs are also a great way for investors to build their track record as they prepare to go out and start their own fund.

Access the full SPV Fees report here.

Venture Is Calling Back Forth The Magic

Last week, I announced the launch of The Fund 0 Circle and I could not be more excited.

Embracing Emergence started as the organic evolution out of my learnings from standing up the investment strategy for a family office in Venture, which I began in 2021.

I have been building, writing, and thinking through Embracing Emergence for two years now, which has manifested in various writings, content, thought pieces, and conversations with Limited Partners, and Emerging Managers.

Many of us who work in Venture Capital love it for it’s magic. It’s an industry like no other. It’s full of vibrant and special people. People who think differently, chase big dreams, and go all in.

It’s an industry that requires convictions, or else you become a reed shaken by the wind.

But over the last years, Venture Capital has become saturated with sameness. Many Limited Partners will tell you that they are currently encountering funds that sound alike, think alike, and invest alike more than they ever have. (I shared this with Forbes the other day).

The term “differentiation” has experienced an entropic process: the exciting energy the term used to communicate to Limited Partners, now just gets spread out into the randomness of the crowd of funds.

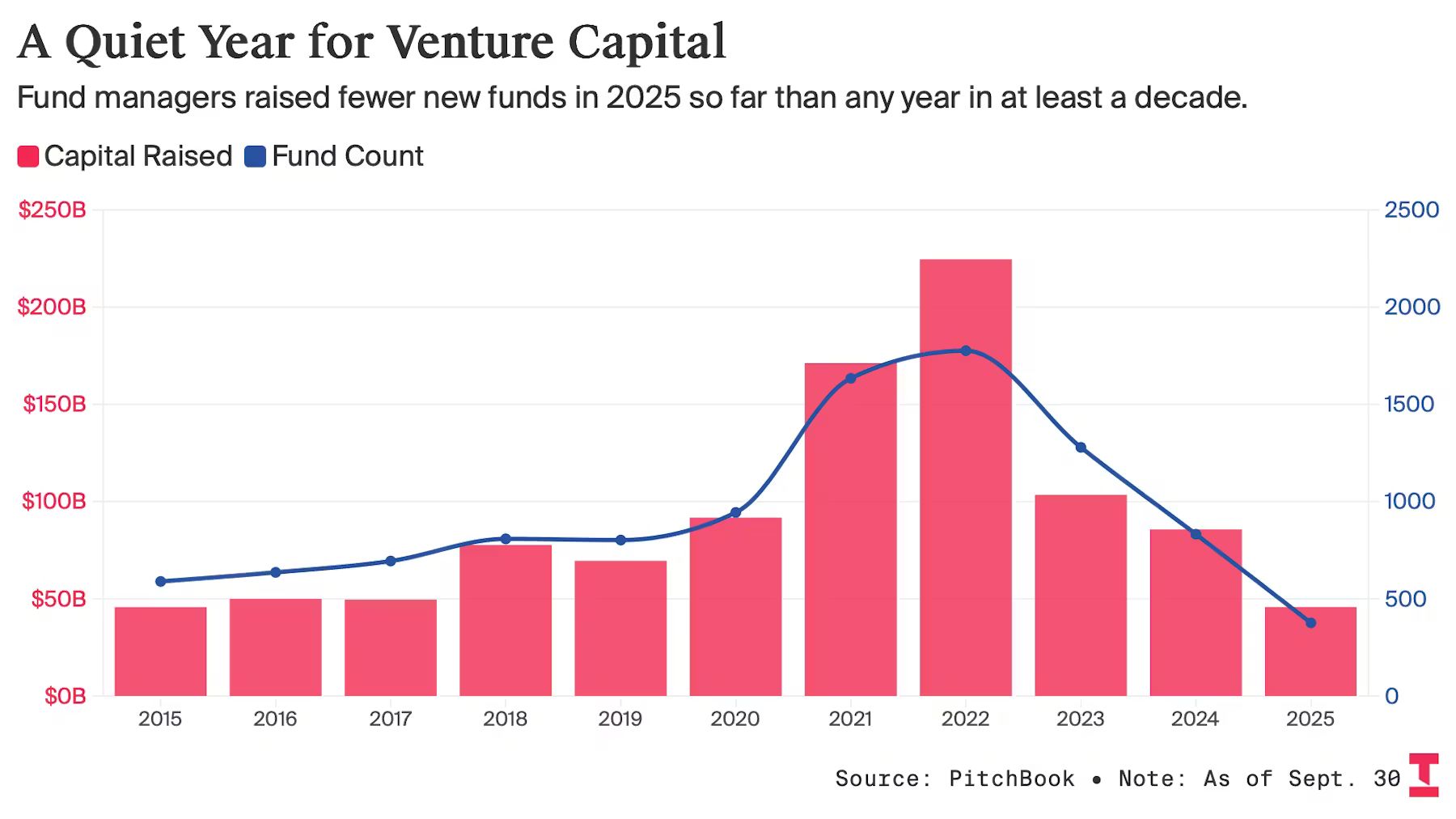

This saturation of sameness manifests itself in the fact that fund managers raised fewer new funds in 2025 than any other year in the last decade according to PitchBook (see below).

But it also means that Venture Capital is healing.

The required standards for Limited Partners to back Venture Capital funds has undergone a rehabilitation after the ZIRP years our industry experienced. 2025 was a year where Limited Partners weren’t necessarily looking for General Partners who were different, but better - also due to the fact that it’s become rare to find GPs who truly do something different.

And frankly, the number of General Partners who are better than anyone else is simply limited.

This re-invention of the deployment standards will most likely keep evolving in 2026. And oftentimes history keeps repeating itself. Venture Capital used to be the industry that was marked by people and strategies that did not fit into other asset classes. People were building companies, and backing founders by choosing the road less traveled.

2026 might just bring this magic, which is unique to Venture, back into our industry. And there are no other funds better positioned to clothe themselves with a top hat and a wand than Emerging Managers.

Our industry is slowly but surely re-voicing the whisper for those, who leave the well-traveled path. It’s beckoning the attention of those, who want to do something different. It’s calling back forth the tinkerers, the refiners, those who are unafraid of rejection, those who cannot help themselves but live out their convictions.

2026 will ask for a new kind of fund, which is why I am more excited than ever to back and support Emerging Managers.

The Fund 0 Circle - Half Monastery, Half Cohort. Inner formation meets the work of making.

On the backdrop of 2025, LPs backing funds more selectively, and there being a new gap for truly different funds, I have decided to launch The Fund 0 Circle.

The Fund 0 Circle is everything Embracing Emergence has been over the last two years, compressed into a 3-month cohort:

It is based on my belief and experience that the greatest investors are marked by a distinct level of conviction, their ability to communicate those clearly, and a compelling alignment that they are doing exactly what they were meant to do.

With that in mind, the purpose of The Fund 0 Circle is not to accelerate you as fast as possible towards raising money from Limited Partners.

It actually should achieve quite the opposite: to slow you down.

It’s number one purpose is to push participants to the highest degree of convictions and clarity so that the outcome is not just readiness to raise a fund, but the birth of investors who are marked by their convictions, clarity, and unique strategy to translate those into their investment approach.

And for that, we have to time to reflect, refine, and compose our thoughts. And it’s better to do this with an intentional start and end date while also being in a vulnerable group instead of doing this by yourself.

Who Can Join The Circle?

The Fund 0 Circle is for Emerging Managers who have raised less than $10M total to date or for angels, operators, or investors at firms, who are thinking about starting their own fund.

Even more importantly, it’s for those who want to do something different or for those who want to find out if they even should be doing this.

The Format

This brings us to the format of The Circle.

The circle will be made up of an intimate group of 15 people. This size will help us create vulnerability, while also forming a strong peer to peer community to help with the journey that is ahead. Including admin, accounting, tax, or fundraising challenges. We will be starting an exclusive WhatsApp group, to which future cohorts will be added over time.

We will be having 6 online session, which will be followed by intentionally designed homework and reflection.

Start Date & 1st Session: 2/11/26

2nd Session: 2/25/26

3rd Session: 3/11/26

4th Session: 3/25/26

5th Session: 4/8/26

6th Session: 4/22/26

Demo day: tbd during program

There will be a cost of $950 for those who get accepted into the cohort.

Will There Be a Demo Day?

The Fund 0 Circle will not have a traditional demo day. Instead, we will be hosting a live “Art Gallery” where all graduates will be presenting a 2-4min essay on their fund/learnings from the program. The Gallery will also be converted into an evergreen digital format where the graduates will have a short video about their fund/learnings.

Attendees of the live Art Gallery will be actively deploying Limited Partners & Emerging Managers from the Embracing Emergence ecosystem. The goal here will not be volume of people, but people who are actually interested and helpful.

How To Apply

You can find the link to the Fund 0 Circle landing page here.

And you can find the application link here.

Other Recommended Newsletters:

Reach out to me if you are writing on Beehiive - always happy to share other great newsletters!