Introduction

I am excited to host another conversation with a fellow Limited Partner I have enjoyed a great personal relationship with over the past years: Nico Mizrahi.

Nico is somebody I relate to in the nature of an apprentice learning from a craftsman. Nico has been backing emerging and undiscovered managers for 20+ years and has truly dedicated himself to becoming a master of investing in people and managers.

He is the founder a Pattern Ventures, a Fund of Funds backing funds of $5M-$50M in size.

If you are an Emerging Manager that wants to learn how a Fund of Funds invests and what they look for in the Managers they back, Nico’s transparent insights will be a treasure chest during this time.

If you are a Limited Partner and are looking to learn how other LPs approach the Emerging Manager asset class, or looking where to get started, this conversation will provide you with Nico’s learnings from the last 20 years and how they are doing things at Pattern.

Embracing Emergence Is Partnering With Sydecar 🤝

Sydecar is the go-to platform for emerging VCs to manage both their SPVs and funds. They are on a mission to make private markets more accessible, transparent, and liquid by standardizing how investment vehicles are created and executed. Sydecar’s powerful software allows Emerging Managers to launch SPVs and funds instantly, track funding in realtime, and offer hassle-free opportunities for early liquidity.

Sydecar acts as the silent operating partner to Emerging Managers, handling all back-office functions in a single place. Say goodbye to chasing subscription docs, lost wires, or late K-1s. And for LPs, as an LP myself, I know how important it is to have an easy onboarding process, along with quarterly capital calls and tax docs, all managed by a trusted platform. Sydecar delivers on all fronts, ensuring both managers and investors have the support they need from a platform they can trust.

Click here to reach out to their team via the exclusive link for our community.

Table of Contents

On Nico’s Craft of Underwriting People

When you’re evaluating fund managers at the earliest stages—fund one or fund two—you’re not betting on track record, you’re betting on the person. And my instinct has always been to disarm them and make them feel safe.

Benedikt: Nico, you have been one of the Limited Partners that I have been fortunate enough to build a relationship with that is more of the nature of an apprentice and a craftsman. It is rare to come across people in our industry that have identified a craft within this asset class that they have committed themselves to mastering and refining.

There are a few things I would like to highlight about you and your life that showcase your long-term commitment to mastering a craft. You’re a husband. You’re a father of two sons. You joined First Pacific Advisors in 2007 and stayed with them and connected to them for 17+ years. You focused on emerging and undiscovered managers while you were there. And in 2022 you co-founded Pattern Ventures to keep partnering with small Venture funds.

You have been playing the emerging/undiscovered fund investing game for such a period amount of time that makes it fair to assume that you love the craft of backing funds and that you are exceptionally good at it.

The name of your Fund of Funds is “Pattern Ventures”. I always like to dive deeper into what people give names to. Because it says something about them, just as much as it does about their business.

Q: You have been mastering the craft of backing funds, what do you think has been a pattern that has marked you personally as an investor, entrepreneur, and person, that has made you so good at backing fund managers?

Nico: To be honest, I think my two superpowers are empathy and relentlessness—and those have shaped everything about how I invest, work, and move through the world. From an early age, I just felt a deep, often overwhelming empathy for people. I was always putting myself in other people’s shoes. Sometimes it was a burden, honestly, but over time I learned it was actually a gift—especially when it came to this work. I always had a really great ability of connecting with people and, and most importantly, disarming them. And I think that is a really important dynamic when it comes to evaluating people.

When you’re evaluating fund managers at the earliest stages—fund one or fund two—you’re not betting on track record, you’re betting on the person. And my instinct has always been to disarm them and make them feel safe. When people feel safe, they let their guard down. They tell you the real stuff—their fears, their childhood, their passions, what drives them. And that’s the information you actually need to underwrite someone.

We’re all window dressing when we first meet, right? You’re basically auditioning. But my job is to see through that. I want to know what they study in their free time. What lights them up. What they’ve walked through. Were they raised by a single parent? Are they an immigrant? What’s the wound that drives them?

I did a program called the Hoffman Institute—it’s all about exploring early childhood trauma—and it gave me language for what I was already doing intuitively. I’m constantly listening for the inner child in someone. Because that’s who shows up when things get hard. That’s who makes the big decisions.

The other part of it is just sheer work ethic. I was never the smartest guy in the room—far from it. I had every learning disability you can name. But my dad taught me early: outwork everyone. So when I started out in my career, I was the first one in, last one out, every day. And I still carry that. When I look for managers now, I’m looking for people who bring that same intensity—people who run through walls. Who obsess over sourcing. Who do a million reference calls. Not for show, but because they care that much.

And honestly, a big part of getting good at this is just reps. That’s why I think Fund of Funds are so well-suited to invest in Emerging Managers. We’re not doing this part-time. We’re meeting GPs all day, every day. We get to build up the sample size. And with enough reps, you start to know the difference between someone who talks a good game, and someone who really has it. That’s when the pattern starts to show up.

Why Small Funds Create the Right Conditions

I’ve always said I consider myself an “emerging or undiscovered” allocator.

Benedikt: At Pattern Ventures, you exclusively focus on funds $5M - $50M in size. The word “Emerging” does not come up on your website or is something you lead with when talking about your strategy. You focus on fund size first. When we talk about investing in Emerging Managers, lots of people mean different things. Some say it’s GPs who haven’t raised more than 4 funds, for some it’s only the first 3 funds, for some it’s how many funds and the size of funds.

I want to highlight the category you picked, because it ties into something I am noticing in the LP world: a lot of LPs do not take enough time to really identify what they are exceptionally good at.

That often results in the fact that we choose the wrong overarching “category” we invest in. We might say “Emerging Managers”, but maybe we’re really good at enabling people at an inflection point and are uniquely capable of identifying when people are at such a point. That might lead me to investing in Fund 3s or 4s. You might also be somebody who recognizes people prior to their full potential fully manifesting, then you might be prone to being an initial backer of Fund 1s.

Q: Why did you formulate $5M-$50M as the defining category of the funds you are investing in?

Nico: Well, look—there’s a lot I could say here, and I could probably talk about it for hours. But to put it simply, we’ve always been focused on the 20—the incentive fee. And I think people really underestimate how powerful the management fee can be in creating complacency. So for us, fund size is about structure. It’s about setting the conditions where the barrier to generate a 5x is lower, and the hunger stays high. That’s why size matters so much to us.

Field note: Sydecar recently published a deep-dive report on how Emerging Managers are thinking about and structuring their fee model. This report uses 39 funds from Sydecar’s platform and highlights how EMs are thinking about fund fees. You can read it here.

I’ve always said I consider myself an “emerging or undiscovered” allocator. I’ve made that very clear. And yeah, we love backing people in the early innings of their investing career, because—if all else is equal—that’s usually when they’ve got the most drive, the most urgency, the most passion to build something special. That’s when the returns can get really interesting.

But that doesn’t mean we’re dogmatic about it. We’ve also backed a highly sought after Fund VII with $20M in size. Because the GP has a differentiated approach, a real reason to win. And the benefit of doing a fund that late is, well, you’ve got data. You can see the arc. So we’re not going to pass on someone just because they’re no longer “emerging.” But our center of gravity? That’s in the $5M–$50M range.

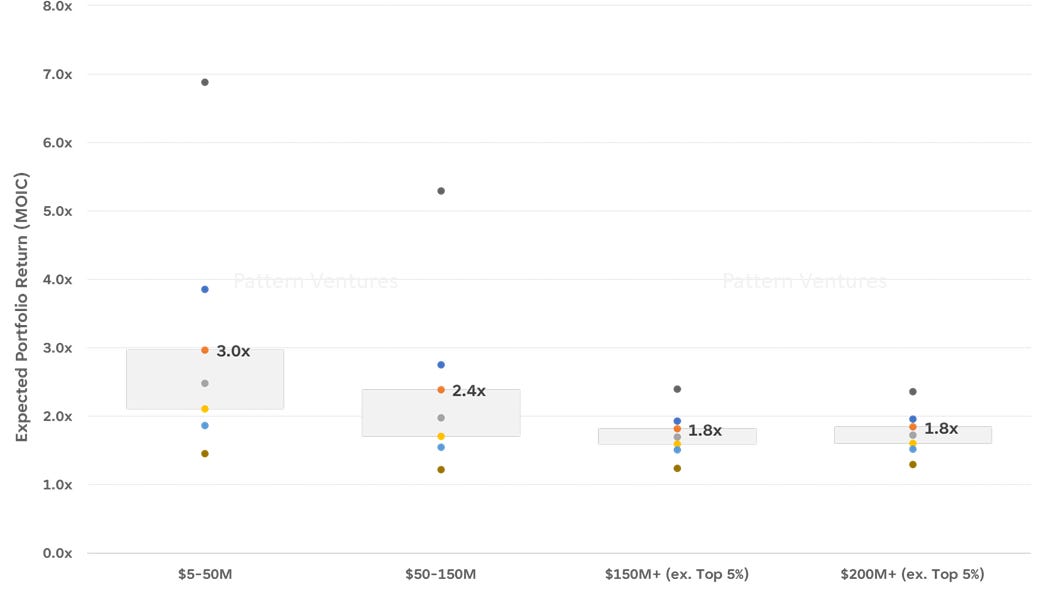

Why? Because we actually believe that’s where the highest concentration of 5x+ returning funds exists and where access isn’t impossible. Everyone knows who the Tier 1 names are—Benchmark, Sequoia, USV—you don’t need a fund of funds to find them. But the incumbent VCs are difficult to get capital into. We talked about this in our “Access and Outliers” paper. We all know who the big funds are that we would like to allocate to. So, it’s easy to find those Tier 1 funds, but it’s impossible to access them. Meanwhile, finding these Emerging Managers is hard—but getting into them isn’t, at least not yet. That dynamic is what makes the fund of funds model compelling.

So we drew a line in the sand. Five to fifty. It helps us stay focused. Could we stretch outside that? Sure—if someone exceptional is raising $60M, we’re not going to walk away. But what we didn’t want was to open the aperture too wide. The moment you say you’ll go up to $100M, the floodgates open, and you just don’t have the bandwidth to do the kind of work we do.

I tell all our LPs this—if someone asked us to raise a $500M growth fund of funds, I’d say no way. I don’t have the brain space or the desire to go to every AGM and keep up with every later-stage firm. I’m on LinkedIn, I’m on the phone, 12 hours a day chasing down one promising GP. That’s my craft. That’s where I want to be great.

I don’t want to be the jack of all trades. I want to be the master—of small managers.

On The Tension Between Data and Backing People

The name for our firm “Pattern.” wasn’t just a branding exercise. When we started the firm, I knew I didn’t want us to follow the typical rules. Yes, we’re looking for patterns—traits, signals, behaviors that correlate with success. But we’re also here to break patterns. To stay open to what doesn’t fit the mold.

Benedikt: One key thing I love about Pattern Ventures and how you operate is that you embrace the tension of data and intuition. Whenever I talk with GPs about LPs they should turn to, Pattern is on my list of top Limited Partners for Emerging Managers. Exactly because you have a thoughtful approach about how you invest. You combine a substantial amount of research, data-driven insights on what types of funds, stages, sizes, etc have performed with your experience as a craftsman of backing managers and who they are as people and entrepreneurs.

Q: In our conversations you often use the word magic to describe what you look for when you back GPs. What is this “magic” that managers possess that you like to back? And how does this look like in your due diligence considering that this is something very human, something that data doesn’t always capture?

Nico: Let me address both the magic we look to back in Emerging Managers and also the tension between a data driven approach and the human side of investing that we like to live in. The name for our firm “Pattern.” wasn’t just a branding exercise. When we started the firm, I knew I didn’t want us to follow the typical rules. Yes, we’re looking for patterns—traits, signals, behaviors that correlate with success. But we’re also here to break patterns. To stay open to what doesn’t fit the mold.

Some of the best investors and technologists I know wouldn’t pass the “central casting” test. They’re not polished presenters. They might not look you in the eye. But the computational genius is undeniable. The ability to connect with technical founders is real. So we have to build a system that allows for that complexity. If all we’re doing is checking boxes, we’ll miss the magic.

Balancing data and intuition is part of our daily work. Data is an incredible tool—it helps us see things we’d otherwise miss. We built internal tools like Pattern Match, which flagged one of the GPs we have backed, because her portfolio was consistently being marked up by tier-one firms. That led us to her. But the data didn’t make the investment—we did, after hours of qualitative diligence.

That’s where the human side comes in. No spreadsheet tells you what someone’s like when they’re under pressure, or whether founders love them. No algorithm can look into someone’s eyes and tell you why they’re doing this, or what they had to overcome to get here.

We’re not trying to be a quant firm. We use data to open doors. But when it comes to walking through them, it’s all about instinct, relational depth, listening to the unspoken. And yeah—sometimes it’s just vibes. And that’s okay. If we’re going to back people, we need to be fluent in the language of both patterns and anomalies.

That’s the tension we like to live in and the “magic” we look to identify in Emerging Managers.

But if we agree that what we’re doing here is backing people—really backing people—then we can’t make the process so rigid that it only catches the people who’ve mastered the pitch game.

Benedikt: One thing I like to address with Embracing Emergence is convergence between GPs and LPs. Right now is the time to find more alignment in mutual understanding, processes, how we can better talk to each other, etc.

Here is a tension I am currently thinking about and I’m curious what you think. It is addressing whose responsibility it is in the diligence process to unveil the magic of the Manager. I think many Managers are currently frustrated with the inefficient process of fundraising. And I believe part of this frustration stems from this aspect of “magic responsibility”.

The obvious is that it’s the Emerging Manager’s job to pitch to the LP. However, I see a lot of deferred responsibility from Limited Partners that does not recognize that it’s their job to ask questions in such a way where they can gain understanding of whether or not the GP possesses magic or not.

I believe this often creates a disconnect in the diligence process between GPs and LPs. If the the GP does not do a excellent job portraying their magic, the LP will move on very quickly. At the same time, the GP will only be able to actually showcase their magic, if the LP asks questions that open up the space for stories and substance for this magic.

Q: How do you think about this responsibility in the pitching process? Whose job is it to actually unveil this magic?

Nico: Look, it’s hard. I think what you’re pointing to is totally real—and it’s part of the reason the whole process can feel broken sometimes. There’s no clean answer. The GP has a job to do, absolutely—they need to communicate why they’re different, why they matter. But not every GP is going to be a world-class presenter, and some of the best investors we’ve ever backed aren’t.

We try to design for that at Pattern. We don’t want institutional handcuffs that make us look for only one kind of communicator. Some of the people we’ve backed couldn’t make eye contact in the first meeting—but when you really listen, the depth is undeniable. So yeah, the responsibility is shared, and yeah, it’s messy. But I think that’s the work.

So yes, the GP needs to come prepared, but the LP also has a responsibility—to create enough space, to ask good questions, to really try to see what’s underneath. And I know that’s not scalable. I know that’s hard. But if we agree that what we’re doing here is backing people—really backing people—then we can’t make the process so rigid that it only catches the people who’ve mastered the pitch game.

How to Pitch Pattern Ventures

After meeting with thousands of GPs, across every asset class you can think of, I’m telling you—I can spot it in five minutes if someone’s trying to fake it. You can’t manufacture the magic. You just can’t.

Benedikt: Another relevant element that address the pitching / fundraising process currently is that it is very difficult right now to get out there and raise. I see a few GPs here and there who manage to raise very quickly, but generally there is little “pattern” to the chaos at the moment.

What Managers are obviously looking for is to bring an LP on board that can function as a signal to either existing prospective LPs that have been living in the land of “uncertainty” and “I need more time” or generally to pitch to new LPs. A Fund of Funds can often function as this signal for Emerging Managers who are raising Fund 1 or Fund 2.

Q: What is something that helps Emerging Managers stand out from the crowd when talking with Pattern Ventures? What is something they can do when pitching that is actually signal amongst an ever increasing atmosphere of noise?

Nico: Yeah… you know, it’s a great question. My knee-jerk reaction is: you either have it or you don’t. There’s not a checklist for this. There’s no formula. It’s vibes. And I know that sounds like a cop-out, but it’s not. After meeting with thousands of GPs, across every asset class you can think of, I’m telling you—I can spot it in five minutes if someone’s trying to fake it. You can’t manufacture the magic. You just can’t.

That said, there are some things that do matter—and they’re usually simple, unsexy things. Transparency. Honesty. Being earnest. Being humble. One specific note to Emerging Managers: Please stop with the window dressing. I can’t tell you how many times someone will name-drop their LPs, and then when I dig into it, I find out that person wrote a $10K or $25K check. That’s not conviction—that’s just noise.

I’d much rather hear you say, "Hey, I talk to Fred Wilson once a month and we look at companies together," than try to drop that he’s in your fund with a tiny check. That kind of thing can backfire, because I’m going to find out anyway. We’re good at our jobs. We’re going to call your old boss. We’re gonna talk to that LP. And if the story doesn’t hold up, it just creates mistrust. There’s nothing wrong with where you are—but there is something wrong with pretending you’re further along than you are. And I think people forget: our network is deep. If I want to know the real story, I’ll get it. So being honest from the start is really key.

The other thing I want to say is this: don’t do this unless you have something truly differentiated to offer. And I mean truly. Because the world does not need another Pre-Seed or Seed fund. Like, the top-down math just doesn’t work. There aren’t that many category-defining companies created every year. And the ones that are? Benchmark, Sequoia, USV—those folks are probably going to find them. So if you’re not bringing something original, if you’re not doing something nobody else is doing, then you really have to ask yourself: why am I doing this?

What keeps me up at night—and I mean this—is the responsibility I carry. We’re managing people’s savings, pensions, generational family money, etc. This isn’t theoretical—it’s real. And we feel that weight every day. So if you’re thinking about raising a fund, and you don’t think you can offer something better than what already exists—then maybe you shouldn’t be doing it.

This work isn’t just fun or cool or edgy. It’s a massive responsibility. And I think more people need to talk about that before they jump in.

So to summarize: do the work. Know who you are. Be honest about where you’re at. And if you’ve got that magic, trust me—it’s going to come through. Just don’t fake it.