Hello {{first_name|Embracing Emergence Community}}!

Discovering the convergence between Limited Partners and Emerging Managers is all about illuminating the pathway towards a meaningful relationship.

The first and often most important step towards that relationship is the first call between the Limited Partner and Emerging Manager. But how should LPs and Emerging Managers think about the introductory call?

In this volume I am going to share my reflections from my time with a family office, jumping on 100s of introductory calls with GPs, and insights Emerging Managers and LPs have shared with me. Also, we’ll sprinkle a little bit of philosophical reflections from Cicero on top…

Today's Volume

Should Emerging Managers share their pitch deck with the Limited Partner prior to the introductory call, or after?

I have asked about 20 Emerging Managers and 20 Limited Partners this exact question and here are the results:

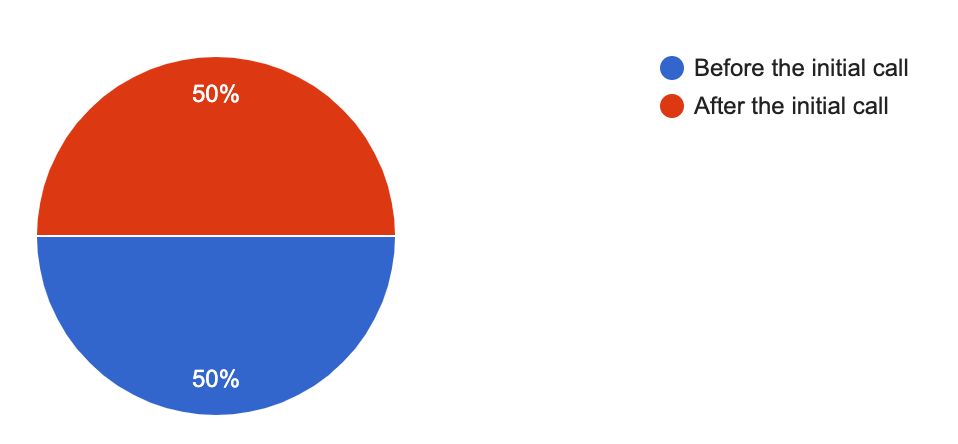

When asking Emerging Managers if it has proven to be a better practice to share the deck prior to or after the initial call, the responses were split right down the middle:

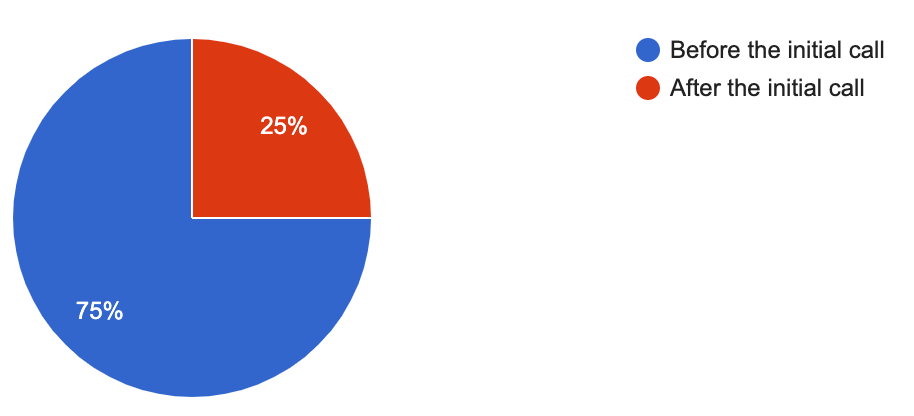

When asking Limited Partners the same question, there was a clear preference to receive the pitch deck prior to the first call. This helps the LP prepare for the call, ask the right questions, and identify initial alignment:

From my time working with a single-family office and establishing an LP strategy, I can confirm that it is clearly beneficial for LPs to receive the deck before the initial call. Reviewing the deck before the call frees up the short period of 30min-1h to ask questions that go beyond the basics like fund size, average check size, stage focus, industry, etc. Having this time is crucial to assess if a second call is needed or if it is not the right fit.

Should a pitch deck be presented during the first call between the LP and the Emerging Manager?

Emerging Managers are clear on this: pitching without a deck, telling stories, and having the space to connect personally have proven to be better practices:

And the response of Limited Partners supports this insight from the Emerging Managers powerfully:

With these responses in mind, it should be clearly stated that the initial call is proving to be more fruitful for both LPs and GPs if the deck is not presented during this time. More on that in the next section below!

Summary

First of all, take these results with a grain of salt, 20 votes are not indicative of what necessarily is right or wrong, but interesting insights nonetheless. What is very clear is the fact that the introductory call should be spent without walking through a deck. In my opinion, this simultaneously should lead to the conclusion that the deck should be shared before the call, so the Limited Partner can get a basic overview and prepare to ask the right questions.

Your input would be appreciated to gain more insights on this!

The Goal of the First Pitch

As mentioned, the best initial conversations I have had with any Emerging Manager are without a pitch deck. The first 30 minutes do not need to be spent going over 12-20 slides of a pitch deck, but should be focused on learning about the story of the Emerging Manager, the background of the LP, and their interest in investing in Emerging Managers.

The key to asking questions about the story of the Emerging Manager for LPs is this: assessing whether or not the story, background, journey, expertise, and character of the Emerging Manager aligns with their fund strategy. Does the background of the Emerging Manager align with what industry they are going to invest in, the stage they are going to invest in, the needed ability to create proximity to the top talent building startups, the skill to pitch other LPs their story, etc. Being a top-tier Emerging Manager is not easy, and Limited Partners should hold Emerging Managers to a high standard. So, conducting due diligence on the Emerging Manager’s ability to win has to start in the initial 30 minutes and is not best assessed by walking through a deck of slides, but by getting a sense for: is this Emerging Manager going to be a force of nature and the right person doing this.

The key to asking questions about the story of the Emerging Manager for LPs is to assess whether or not the story, background, journey, expertise, and character of the Emerging Manager aligns with their fund strategy.

I would advise LPs to find ways to identify the Emerging Managers philosophy just as much as the Emerging Managers history (track record, professional experience, etc.). The track record of the Emerging Manager should not be the #1 priority for diligence.

This means, understanding the Emerging Manager’s character, parts of their personal history, their psychological drivers, decision-making patterns, how they build relationships, are they better at getting access or are they better at picking? You are not investing in the Emerging Manager’s past companies, you are investing in this fund right now. Hence, a reductionist approach to conducting due diligence on the Emerging Manager might lead to missing the true value the Emerging Manager might have. Asking questions as the LP is all about finding value in places that most others would miss - more on this further below.

Peter Lacaillade, a Managing Director at SCS Financial Services who manage over $30B in assets, was an early backer of Founders Fund, a16z, Thrive, Greenoaks, etc. In his episode on 20VC, he talks about why now is the best time to invest in Emerging Managers. Throughout the conversation, he mentions that assessing the Emerging Manager’s track record should be #3 or #4 on the priority list for diligence. I highly recommend listening to the full conversation:

Many Emerging Managers have confirmed that there is a clear correlation between a conversation without sharing a pitch deck for the first call and the resulting successful partnership between LP and Emerging Manager.

A takeaway for Emerging Managers should be that the initial call is not just an opportunity for the potential LP to conduct due diligence, but also vice versa. The first 30 minutes can provide the Emerging Managers with indicative insights into whether or not this can be a fruitful GP-LP-relationship for the next decade.

Emerging Managers should take this time to observe what kind of questions the Limited Partner is asking initially. A few things the type of questions the LP is asking can indicate:

What part of the puzzle are you as the Emerging Manager playing in the LP’s portfolio?

Can you identify enough relational alignment to continue the process?

What is the experience level of the LP in terms of assessing Emerging Managers (prioritize accordingly)?

Cicero on What Stories to Pitch

There are two sides to the coin when it comes to Emerging Managers sharing the stories that matter.

On one side, Emerging Managers need to consider which stories are those that are compelling to the particular LP that they are talking to and highlight their alignment with their strategy.

On the other side, Limited Partners need to be asking the particular Emerging Manager they are talking the right questions in order to extract the insights that will either indicate the alignment with the Emerging Manager or indicate that this is not the right opportunity.

How GPs should pitch the stories that matter

I like to read ancient books. The probability for something, which has been true for the last hundreds of years, to remain true today is simply higher than trusting contemporary wisdom. Some of the best business books I’ve read are from Blaise Pascal, St. Augustine, Seneca, or Cicero.

I recently read Cicero’s Treatise on Friendship, which was originally published in 44 BC. In this book, Cicero defines what true friendship looks like, why it is one of the most precious elements of life, and how to obtain it. He wrote the following:

"Every man can tell how many goats or sheep he possesses, but not how many friends."

It made me reflect upon the fact that I know many Emerging Managers who are excellent at talking about their fund size, why the market dynamics are favorable to the stage they are investing in, their portfolio construction strategy, their track record, etc. These are their goats and sheep.

But so few are great, and I mean truly great, at telling LPs about how they are practicing unique proximity with founders. Once Emerging Managers harness the craft of talking about their unique stories with founders, they set themselves apart from the crowd, and become compelling. Once Limited Partners can identify that the Emerging Manager has a unique way of fostering close relationships with the best talent and winning those relationships, it is a clear signal that this Emerging Manager is in the position to generate alpha returns.

How LPs can get to those stories

Now, it is the Emerging Manager’s job to pitch those stories to the LP, but if you want to be an excellent LP, you have to learn how to uncover those stories. This will give LPs a unique advantage in assessing the best Emerging Managers and building a fund portfolio that can outcompete the typical venture fund.

Here is the key: Learn to ask the questions that lead you to finding value in unexpected places.

There have been many calls where I ended up talking with the Emerging Managers about their upbringing, their insecurities, what they are trying to prove to themselves, if they involve their gut in their decision-making, etc. I approach these questions as a laboratory, not as a recipe to a certain outcome. Let the question lead you where you need to go, only then will you find the place where the value of the Emerging Manager lies that only few will find. And if you don’t find it, it probably isn’t the right opportunity.

Get involved with Embracing Emergence

If you are a Limited Partner actively investing in Emerging Managers or interested in the asset class, respond to this email and we can connect!

If you are an Emerging Manager looking to exchange thoughts around pitching LPs, respond to this email and we can connect!

Let me know your thoughts on today’s volume by responding to this email - it will go directly to my inbox.

What topics are you interested in reading more about?

Want to schedule a call? Respond to this email or shoot me a message on LinkedIn!