Introduction

I am excited to share another conversation with a Limited Partner whose insights have shaped how I think about this work: Matt Curtolo.

Matt is one of the few people I’ve come across who truly sees both sides. He has over two decades of institutional experience, has deployed over $5B in private markets, and has been directly involved in 500+ GP relationships. After roles at Hamilton Lane, MetLife, and Hirtle Callaghan, he most recently served as Head of Investments at Allocate. Today, Matt is walking a rare path—advising both GPs and LPs while helping build stronger partnerships between the two.

What I’ve always appreciated about Matt is that he doesn’t just repeat best practices—he names the gaps. He’s clear-eyed, generous with his feedback, and unafraid to say the quiet part out loud, which he did in our conversation…

If you’re an Emerging Manager looking for insight into how LPs think—and what actually helps move LP relationships forward—Matt offers not just tactics but hands-on advice.

Embracing Emergence Is Partnering With Sydecar 🤝

Sydecar is the go-to platform for emerging VCs to manage both their SPVs and funds. They are on a mission to make private markets more accessible, transparent, and liquid by standardizing how investment vehicles are created and executed. Sydecar’s powerful software allows Emerging Managers to launch SPVs and funds instantly, track funding in realtime, and offer hassle-free opportunities for early liquidity.

Sydecar acts as the silent operating partner to Emerging Managers, handling all back-office functions in a single place. Say goodbye to chasing subscription docs, lost wires, or late K-1s. And for LPs, as an LP myself, I know how important it is to have an easy onboarding process, along with quarterly capital calls and tax docs, all managed by a trusted platform. Sydecar delivers on all fronts, ensuring both managers and investors have the support they need from a platform they can trust.

Click here to reach out to their team via the exclusive link for our community.

Volume #33 Topics:

The gaps between GPs and LPs and how to address them

How GPs should manage their LP-CRM

The role of data vs intuition when backing Emerging Managers

How to stand out to LPs as an Emerging Manager

Table of Contents

The Gaps Between GPs and LPs

[GPs] don’t know what LPs are really thinking, and 80% of the ones I work with say they get no feedback at all when an LP passes. On the LP side, they often don’t know how to communicate their decision-making clearly without introducing unnecessary friction or conflict.

Benedikt: Matt, you have 20+ years of institutional experience, allocated over $5B, and now you are advising both GPs and LPs in order to refine their practices.

It is one thing to be someone who is actively working on bridging the gap between two parties. It is another one, to be a person who has an eye for gaps and identifies them.

First of all, what gave you the ability to identify the gaps, opportunities to realize more potential, or blindspots that GPs and LPs have?

What gaps did you notice that gave you such high conviction to roll up your sleeves and come alongside GPs and LPs?

Matt: It really came from the breadth of my experience across different types of LP platforms. I’ve worked with public pensions and sovereign wealth funds at Hamilton Lane, smaller institutions and families at Hirtle Callaghan, a large balance sheet at MetLife, and then at Allocate, where we focused on making private markets accessible to new entrants—emerging managers and LPs alike.

Each seat had its own blind spots. Endowments see things differently than family offices. Insurance companies think differently than OCIOs. Being exposed to all of them gave me a 360-degree view of the market and helped me spot the common disconnects.

One of the biggest was the lack of transparency and feedback. GPs—especially emerging ones—often operate in a vacuum.

They don’t know what LPs are really thinking, and by my own informal survey, 80% of the ones I work with say they get no feedback at all when an LP passes. On the LP side, they often don’t know how to communicate their decision-making clearly without introducing unnecessary friction or conflict.

Sydecar’s Emerging Manager Fundraising Checklist offers practical guidance on highlighting your unique edge, featuring an example of a fund manager who does this well that you can model in your own story. Check it out here.

My time at Allocate was especially clarifying where I got to actively engage with both sides. You see how many GPs are trying to gain traction and how many LPs want actually want to invest and gain access, but there’s no bridge between them.

So that was the gap I saw, with a goal to give GPs and LPs better feedback loops. If you don’t know where you’re missing the mark, you can’t improve. My current focus is on helping both sides avoid landmines, communicate more clearly, and actually understand each other’s world.

Why LPs Need Repetition & How It Affects Emerging Managers

There’s also the relational layer. Do they ask about my background? My program? That might sound selfish, but it actually signals partnership orientation. If someone just wants to walk through slides page by page, that’s usually a red flag for me.

Benedikt: You have been directly involved in 500+ GP relationships. One thing I often try to highlight on Embracing Emergence is the importance for Limited Partners to develop a taste for the best Emerging Managers through repetition.

You have more reps than a majority of LPs I know, how do you relate to the importance of repetition for allocators and Limited Partners? Is it important? If so, why? And how does it affect Emerging Managers?

Matt: Repetition is absolutely essential. I’ve had the pleasure—or really the honor—of hiring and training a lot of junior folks, and I always used to tell them: if you don’t want to give money to the first ten GPs you meet, you’re not paying attention. That is a way to say, it takes time to develop a healthy skeptic’s mindset.

Repetition helps you develop two things: your own personal taste, and an ability to recognize nuance. I like the wine analogy you previously wrote about. I’m not a huge wine drinker, but I know the difference between good and bad. The real skill is being able to tell the difference between good, great, and excellent—and to understand the gradations between them. That’s the level of discernment you need when you’re evaluating managers.

When I talk to a GP, I’m listening for how they deliver a message. How do they talk about an underperforming portfolio company? How do they frame a new hire? Can I sense conviction in their voice? I’m also paying attention to how they package their materials. In a meeting, especially on Zoom with multiple people, are they making space for others? Those are subtle cues—but they say a lot. And you don’t pick up on that right away. It takes reps.

When I was earlier in my career, my job in meetings was effectively as a scribe, taking manual notes, with pen and paper.. That sounds outdated now, but it taught me to listen closely. You couldn’t write everything, so you have really need to capture the essence of the moments. You start to notice how someone carries themselves, how they answer questions, how they react when something doesn’t go their way. That’s where you start developing pattern recognition.

There’s also the relational layer. Do they ask about my personalbackground? My program? That might sound selfish, but to me, itsignals partnership orientation. If someone just wants to walk through slides page by page, that’s usually a red flag for me. I can read a deck. What I want is a conversation.

CRM & LP Management for Emerging Managers

Here we cover:

1. How to be visible to LPs

2. Finding your ideal customer profile (LPs)

3. Time cost of educating LPs

4. Triage in the mid-funnel

5. How to maintain interest

Benedikt: One thing many Emerging Managers bring up in the current environment is the discount they oftentimes have to take on their time. Fundraising processes with Limited Partners can be long. Many require various cadences for follow-up, sharing updates, etc. Oftentimes GPs invest a lot of time in potential LP relationships that do not end up converting into a check.

What are some practices that you have seen GPs successfully develop for their CRM management of potential LPs? How should they structure their follow ups? Who should they prioritize speaking to? When should they move on and focus their efforts elsewhere?

Matt: I recently hosted a whole interview series called Always Be Fundraising for Private Equity Marketeer, where we asked LPs and IR professionals all the tactical questions GPs are constantly wrestling with: What’s the right cadence? How do you prioritize who to follow up with? When do you walk away? The truth is, it’s not a science—but there are a few patterns that consistently work.

First, you have to be proactive. Create some pull so LPs even know you exist. That doesn’t mean you need to be putting out content or doing podcasts, but at a minimum, your presence needs to be felt. That can come through soft marketing—leveraging your existing LP relationships, keeping your network warm, and staying visible.

Second, really dial in your ICP—your ideal customer profile. I can’t tell you how many $10M funds ask me to make an intro to a large institutional allocator (like MetLife). I can do it, but it’s not going to be a good use of your time. The most likely early believers for small emerging funds are family offices, individuals, and maybe a few boutique fund-of-funds. Know who your most probable buyers are, and shape your messaging for them. Don’t spend your precious time chasing LPs that, structurally, are unlikely to say yes for that first fund.

There’s also a time cost to educating LPs. For example, if I know nothing about deep tech and you’re pitching me a deep tech fund, you might have to educate me first on the market, then tell me why your firm fits within that market, and then convince me you are the right person to win. That’s three layers of storytelling. It’s not that you shouldn’t take those meetings—but you need to appropriately weight them in your CRM. Some LPs are going to require a longer arc. Be honest with yourself about that.

Once you’ve built your pipeline, do aggressive triage in the mid-funnel. Be direct. Ask questions like: What would it take for you to get to a commitment? When should I follow up? Then take people at their word. If someone says, “Check back in at the end of the year,” great—note that, and follow up then.

A lot of GPs fall into the trap of trying to convert skeptics. Maybe it’s a pride thing—but that’s almost always a Fund II or Fund III play. You’re not going to win over every LP in Fund I. Some relationships take years. So if an LP gives you a no, or a non-committal maybe, put them on a separate track. Don’t burn cycles chasing them when you could be deepening conviction with the people who already get it.

So all of this—CRM structure, cadence, updates, follow-up prioritization—it’s about managing momentum. That’s the whole job. You’re trying to maintain interest, give enough insight, and keep moving things forward. And if you do it well, you’re not just saving yourself time—you’re actually increasing the odds that someone will say yes when the time is right.

Intuition vs. Data When Backing GPs

[…] I think track record and benchmarking can be red herrings. We’re not buying the past—we’re trying to understand what’s repeatable and predictive going forward.

Benedikt: In a conversation with our friend David Zhou (link below), you mentioned that you start the process with a Fund 1 at a default “NO”. The point of the process is to then find answers to your questions to get the “NOs”out of the way.

You also are a strong voice in the LP-community that acknowledges that we back people, their story, and unique gifting when we back first-time managers.

Some of the aspects of Emerging Managers requires gut and intuition. Where do you see the role of your gut and intuition when it comes to “tearing down” “NOs” and what role do more data-driven elements like the data room, track record, etc. play in comparison?

Matt: Stating that I start with a default “no” was hard to put out there because people can misinterpret it—as if I don’t want to believe in people or think they shouldn’t be in business. That’s not it. I work primarily in venture, and by nature, we’re optimists. But from an LP perspective, you have to start with healthy skepticism—especially in an asset class where you’re committing to a blind pool.

For me, it’s simple: I begin with a “no” and the diligence process is about giving someone the opportunity to earn a “yes.” And once that switch flips, it’s a default yes. They get the benefit of the doubt. My hope is that if I make a first commitment, we can be partners forever. I front-load the work because the feedback loop is so long—sometimes 7 to 10 years, or longer, before you know whether a decision was “right.”

This is where intuition plays a big role. I like to say: you make decisions with your heart and confirm them with your head. Gut gives you the lean, the pull. Then you dig into the data to either support or challenge that instinct. But data alone rarely gives you the answer—it gives you better questions. You’re not going to find conviction just by opening a spreadsheet or reviewing a track record.

In fact, I think track record and benchmarking can be red herrings. We’re not buying the past—we’re trying to understand what’s repeatable and predictive going forward. So I focus more on people and process. How did they do it? What’s their operating rhythm? Can I trust them to keep showing up?

It’s all about building a process that gets you to 80% confidence—and then being honest with yourself about what you’re really seeing.

Better, Not Different. Differentiation Is Not The Pitch

Benedikt: One other point I would like to give voice to that will provide insight for the readers is the topic of differentiation.

I think many LPs will acknowledge that we can count truly differentiated GPs with innovative approaches and models on one or two hands.

So how can Emerging Managers stand out in the current fundraising environment?

Matt: Differentiation is tricky, because everyone talks about it, but few people define it the same way. A lot of LPs come to me and ask what I’m seeing in the market, and because I sit between GPs and LPs, I get to see the full range. GPs are often more honest with me than they are in formal pitches, and LPs value that perspective. But the language we use around differentiation gets muddled fast.

The words I hear most often are “small,” “different,” and “interesting.” And frankly, I throw out different. What does that even mean? There is a good chance that I’ve seen 30 managers doing a similar thing. “Different” looks completely different to each of us. And just because something is targeting a white space doesn’t automatically make it compelling. Contrarian doesn’t mean good—it just means contrarian. There might be a reason no one else is doing it.

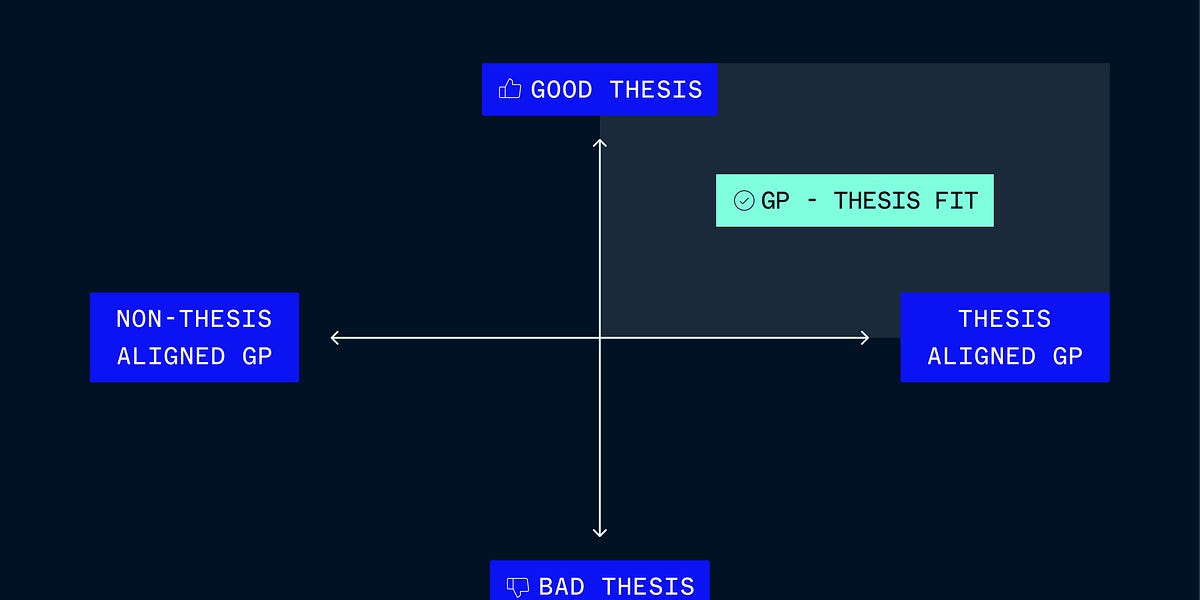

So I tell GPs: don’t aim for “different.” Aim for better. Show me how you are the right person to be executing this strategy. At Allocate, my colleague John Felix and I called it “GP–Thesis Fit.” Are you the right person doing the right thing at the right time? You can’t always control timing, but you can control how clearly your strategy aligns with who you are. If you’re in a crowded space, you don’t need to be original—you need a sharper lens. Show me your edge.

I’m also big on words. I had an awesome mentor at Hirtle Callaghan named Jamie Johnson, who spent time in his prior life as an editor, and he instills this focus in me. I cringe when people use terms like “unique” or “proprietary” without precision. “Unique” means one-of-a-kind. There’s no such thing as “somewhat unique.” And “proprietary” means no one else can access it—so unless that’s actually true, don’t say it. Those words get thrown around because people feel like they need to sound differentiated, but real differentiation is more grounded.

The one thing that is truly unique—and can’t be copied—is you. Who you are, your lived experience, your point of view. There’s not another you. And yet, so many GPs shy away from leading with their personal story. They talk about the strategy, but not their connection to it. That’s the biggest missed opportunity. The best foundation for partnership is when I can see a clear, personal through-line between who you are and what you’re building. That’s what sets you apart.