About This Issue

By the end of this year Embracing Emergence will be 2 years old. It has grown from a newsletter to a place where Emerging Managers and Limited Partners can interact together, have conversation, and explore how they can find closer together.

Embracing Emergence’s numbers since it started

I am proud of all these stats that represent the engagement with Embracing Emergence since it started. A 64% average open rate is something that makes me grateful and honored - our inboxes and feeds are full with content and requests and it’s a privilege to see how many people take the time to read these issues.

Today’s issue is one that I hope is one for to be saved in the bookmark bar on your device. These convictions are the basis of what made me start Embracing Emergence and are also listed in my very fist issue that I published. This newsletter volume represents my years of reflection of why I believe Limited Partners should invest in Emerging Managers. These are my opinions, this is not investing advice.

Embracing Emergence Is Partnering With Sydecar 🤝

Most managers have a clear thesis, but turning that thesis into a well-constructed portfolio can be challenging.

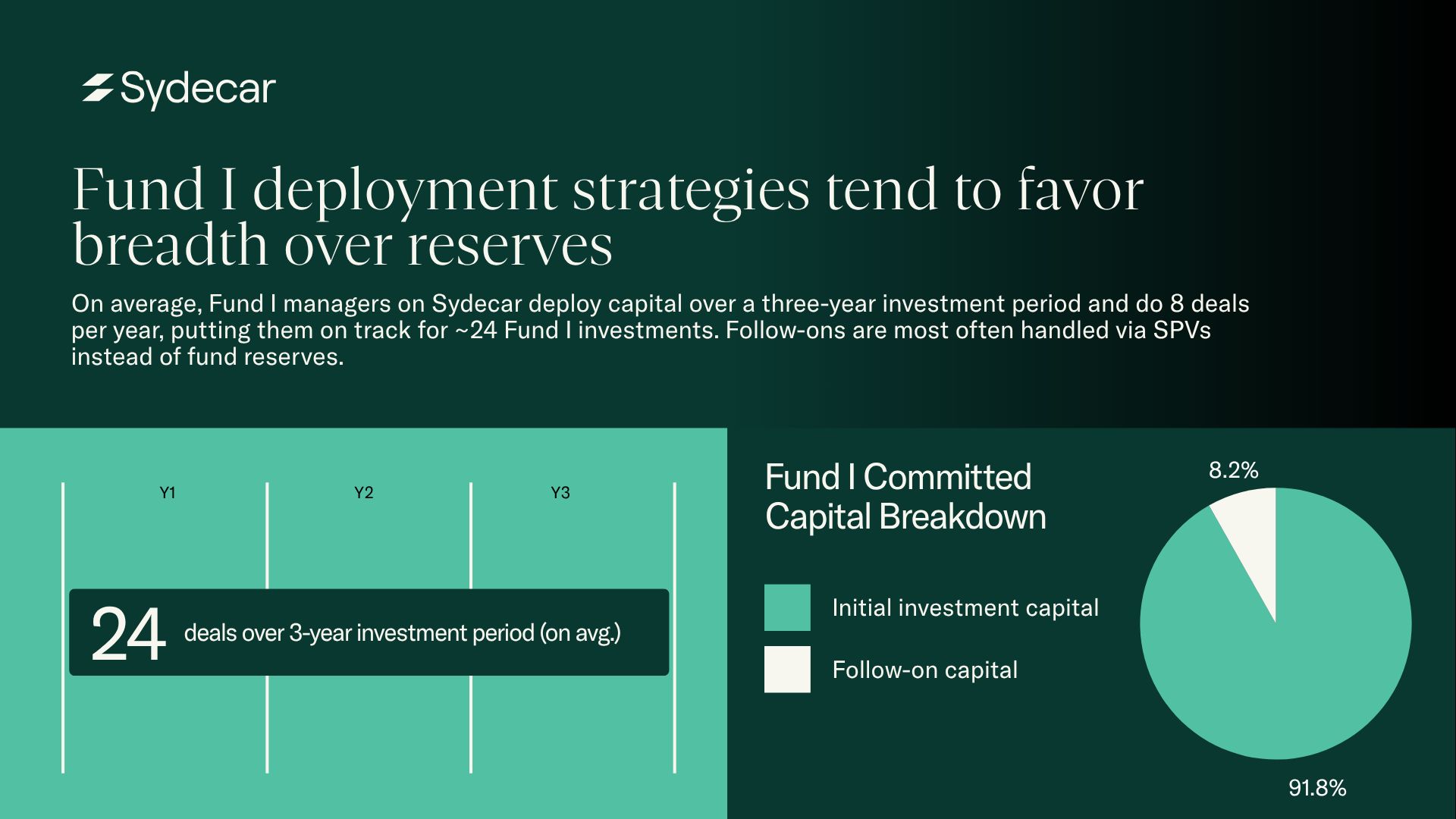

Sydecar analyzed how emerging managers on their platform structure their portfolios, including:

Typical investment timelines and number of portfolio companies

Use of SPVs versus fund reserves for follow-on investments

Average check sizes and valuationsFund 1 managers on Sydecar use less than 10% of their capital for follow-on investments, but instead leverage SPVs instead of their fund reserves.

Get the full data-driven guide to portfolio construction here.

Table of Contents

This Is Not A Recipe

Before we dive in, I want to make very clear that this is not a recipe to land a Limited Partner or a list for Limited Partners to 100% make sense of why to back Emerging Managers.

Investing in Emerging Managers is HARD. It takes years to build up the desired quality of deal flow. It takes an INSANE amount of time to sort through the ecosystem. It is sheerly impossible to ever get 100% assurance that you are making the right investment. You lack data. You have to depend on your human skills more than you might be comfortable with. There are hundreds of funds to sort through, and only few that you should invest in.

It goes on and on and on.

But, this newsletter issue will list all the reasons I have found conviction around of why Emerging Managers are the right investment for Limited Partners.

I would encourage to take these points, reflect on them with your team, refine, prioritize, make them your own. And of course, please feel free to reach out to me if you want to brainstorm these with me: [email protected]

Attractive Risk / Return Profile

The Return Profile:

For Limited Partners it is important to understand how the risk and return profile of Venture Capital investing has changed over the last years. Especially for family offices, which generally invest over generations, not cycles, it is crucial to constantly re-assess how returns are driven and where risk can most effectively be mitigated. Over the last years the Venture Capital landscape has become more and more commoditized. You can now spin up a SPV or even fund by pushing a few buttons, filling out a form, and hit the ground running.

This means that the best returns are no longer limited to a few established fund managers, who oftentimes can be difficult to access for the majority of LPs. But it also means that it is more difficult than ever to find the signal amongst the increasing noise.

The below figure highlights this evolution and shows that top returns have consistently been generated by Emerging Managers (Funds 1-4):

Source: Cambridge Associates, as of June 30 2019.

From 2004 to 2016, the top-performing Venture fund was a new or developing fund (Fund 1-4), 9 out of 13 times. Out of the Top 10 funds over the observed vintage years, only 35 out of 130 were established funds.

Pattern Ventures, a specialized Fund of Funds, supports this narrative across a broader pool of funds. In their report “Access and Outliers”, they analyzed 2,500 funds from 1980 onwards. To summarize:

A portfolio of smaller funds (up to $50M in fund size) has the potential to outperform a portfolio of larger funds (funds above $150M in size) by 45-60%. This calculation excludes the top 5% performing large funds, suggesting the improbability for many LPs to access those.

Source: Pattern Ventures

What should be layered on top here is the return profile of a portfolio of various LP positions, which strengthens the narrative around the attractive return profile of Emerging Managers. More on this under “Fund of Fund Approach as Extra ‘Sauce’”.

The Risk Profile:

The various reports and data illuminates that Emerging Funds are not more risky than established funds. As the data suggest, Emerging Managers actually have the potential to create a significantly higher upside for their LPs. Especially considering the probability constraints for many LPs to access and actually invest in the best established firms.

At the same time, I would like to encourage to keep in mind that there is a survivorship bias woven into the data we currently have on Emerging Funds. Many emerging funds, that have had to shut down, will not have been reported and therefore the data might not accurately represent reality, even though it can be indicative of what is true.

Also, the famous Cambridge Associates figure showing that Emerging Manager Funds have been the top performing fund 9 out of 13 times from 2004 to 2016 is encouraging, but looking at the best 10 funds of any given vintage year should not lead to any conclusions. It can show LPs the excellent potential to outperform any established fund with Emerging Funds but is not necessarily predictive of the outcome of the LP’s portfolio. The probability of finding those top-performing funds should be considered.

With that in mind, the risk profile of establishing a strategy around Emerging Funds is shaped by the access LPs have to the top-performing GPs.

The amount of new funds that are forming can be overwhelming at time. Finding the best Emerging Managers oftentimes now represents finding a needle in a haystack. All while also cultivating the right network of access, which takes a long time and a significant amount of intentional pursuit.

Having access does also not equate to the ability to pick winners.

Another risk is that the performance is simply difficult to predict based on a lack of track record in comparison to what LPs would be able to assess when investing in established funds. For VC Funds, previous top-quartile performers managed to keep top-quartile performance for their next time 45.1% of the time. This means that you almost have 2x better chances of hitting a top-quartile fund when investing in a fund with an established track record indicating repeated top-quartile performance. As part of their nature, emerging funds simply can’t show for this. Even if the GP themselves has a track record, investing and managing a firm is a completely different game than being an angel or professional investor.

The Fund of Fund Approach as the Extra “Sauce”

Fund of Funds are a key signal LP for any Emerging Manager to land. So for Emerging Managers it is important to understand their world.

Also, you don’t have to be a Fund of Funds to take advantage of these numbers. But, Fund of Funds typically have a special edge, experience, access, etc. that enables them to generate the below returns.

According to my friends at Mountside Ventures, 85% of the surveyed FoFs invested in Emerging Managers:

Source: Mountside Ventures, as of Q3 2023.

Fund of Funds represent both for LPs and Emerging Managers a great access point to take advantage of the risk/return profile of emerging funds, as well as insights and learning opportunities around the craft of backing GPs.

When analyzing fund performance for Fund-of-Funds investing in the US and Europe, the data makes clear that early vintages show strong financial returns across both the top quartile, median, and third quartile. Any vintages post-2016 also show reasonable upside but are still in the process of maturing their fund cycle and full return potential.

Source: Prequin, as of Sept. 2023.

I will also say this plainly: as the data shows, even if you are a bad Limited Partner, the probability of loosing your money with a portfolio of funds vs. a direct portfolio is SUBSTANTIALLY lower. Don’t invest in Venture to optimize for not going to 0, but still, something that will get many LPs comfortable with the asset class of emerging funds.

The point I am making is that when LPs build out their own portfolio of funds, they have a good chance of outperforming funds that invest directly in startups. The additional benefits for LPs are strong diversification, mitigation of a lot of risks, and access to co-investment opportunities, learnings, etc.

Incentive Alignment

This point of convergence between Emerging Managers and Limited Partners needs to be at the top of the list. The alignment around the financial incentive between LPs and GPs MATTERS A LOT!!!

When you back Emerging Managers, you back their absolute need to win. You want to back the GP for whom this is their last career. They need to win, and they need to make the win worth it.

Emerging Managers oftentimes leave lucrative and well-paying jobs. They sacrifice their cushion, their 401k, etc. Mostly all Emerging Managers start out by taking a big pay cut.

Some funds are more incentivized around management fees, some more around the carry. Emerging Managers are carry incentivized. They are not incentivized to run the fund, they are incentivized for the fund to return as much capital as possible. Not to raise as much as possible.

And even though Emerging Managers need to make a living, larger funds often take higher fees than smaller ones.

As reports show, half the funds above $100M in size take a 2.5% management fee, vs ~44% of funds below $100M take 2%, some even less.

For Emerging Managers, the management fees typically just serve as a way to cover overhead and salary for the Emerging Manager, but it is not the way to financial freedom.

This is where the LP and GP find alignment: they both need to produce Venture-type returns in order to make the money that is worth the sacrifice. Plus, if the Emerging Manager does not generate the appropriate returns, the likelihood of raising the next fund drops significantly.

Easier Access

Any investor who has both invested directly in startups and in funds knows: you need to spend less time hunting and chasing the best GPs vs the best founders. There are more startups than there are funds.

I’ve spent endless hours talking with founders, trying everything in the book and out of the box to get to the best startups out there. I even built a network of VC Associates to share deal flow with the top firms and their associates - at the peak, I made 1,000 introductions annually between VC Associates to facilitate deal flow.

And here is the truth: the best founders can choose who they want on their cap table. And a family office (or other typical LPs) are often not the number one choice.

This is different with Emerging Managers. First, there is the obvious reason, that every Emerging Manager is fundraising and happy to talk to a potential LP. This substantially increases your probability of accessing the best funds.

Secondly, if you’re an LP, you have the opportunity to actually add value to the GP. Your relationship can be aligned in a way that creates a mutual desire for both GP and LP to seek investment.

“Influence-to-Investment Ratio”

Influence-to-Investment Ratio = Check Size * Proximity

This ratio describes the amount of influence, voting rights, or what kind of seat at the table your check buys you. When investing in an Emerging Fund you have the opportunity to be proximate to the GP.

If you compare the check you would have to write when investing in a top startup (if you could even get in) to receive some position of significant influence in the decision-making, it is often the case that the check to have a similar influence as with GPs needs to be substantially hire when backing a startup.

Emerging Funds are a great opportunity to get a seat at the table and to be in proximity to the GP, while writing reasonable check sizes.

At the same time, this ratio proposes that your influence is not only dependent upon the check size but also on the proximity the LP is fostering with the GP. Good LPs read updates and give feedback here and there, great LPs are hands-on and help.

Time Efficiency

This is the least sexy reason to back Emerging Managers, but honestly one of my favorite ones.

The amount of time you have to spend to find and invest in the best startups vs. finding and investing in the best Emerging Managers is substantially different.

If you want exposure to Venture Capital that is time efficient, while at the same time offering top return potential and the potential to mitigate risk, investing in Emerging Funds, in my opinion, represents a good opportunity.

If you want to invest in the top founders building tomorrow’s Uber, while getting in the round early enough to have a round pricing that supports making outlier returns, you have to meet the founder before they raise their round and then also compete with the established Venture Firms. It takes a long time and a lot of work to build that kind of network and reputation. And even if you get to the talent, you can’t take that access you’ve worked hard for to the bank.

Getting access to the best Emerging Managers still requires a lot of time, but it is, generally speaking, more time efficient, considering that most LPs juggle various investment strategies at the same time.

Time To Build Trust

My friend David Zhou recently made a post that will help to provide color around this point of convergence:

He highlighted an LPs’ opinion that “Every pitch needs to have energy, intelligence, and integrity. And without the last, the first two can lead bad outcomes for the LP.

After talking with hundreds and hundreds of Emerging Managers, you can detect the first two within the first seconds or 2 minutes of a conversation.

But what is intrinsic to the trait of integrity is, that it is proven over time. You can assess the track record of somebody’s track record around their integrity with the needed reference checks, which any good LP should do. But integrity and trust takes time.

I like trust. I value trust a lot. Hence, I have to like time. When backing Emerging Managers, you have more time to build that trust vs. when backing the best startups.

Look, the best Emerging Managers are still oversubscribing and you have to move fast. But still, the required pace does not come close to how quickly you have to back a great startup.

Co-Investment Opportunities

I have heard mixed things from LPs on this: some say they actively participate in co-investment opportunities, some say they do but never actually invest, some don’t care too much about it.

So, I put together a quick poll to find out more:

As a LP, have you made use of co-investment opportunities?

Co-investment opportunities represent another factor, which can make investing in Emerging Managers attractive for LPs.

Your typical Fund 1-3 most likely is in the $10-$50m, sometimes up to $100m, ballpark. Depending on the portfolio construction strategy of the GP, follow-on capital for portfolio companies, who are indicating a pathway to success, is limited.

In later rounds of portfolio companies, Emerging Managers can find themselves in the position of having run out of dry powder and are unable to execute their pro-rata. This is where LPs can step in and get access to a direct opportunity they most likely wouldn’t get themselves.

Also, Emerging Managers oftentimes will put together SPV opportunities through which LPs have the opportunity to participate in rounds of promising companies. LPs now not only have unique access to a direct investment but can also benefit from the conducted due diligence of the Emerging Manager.

Co-investment opportunities can give LPs the desired reps in conducting due diligence on startups, provide de-risked access to outlier companies, compound your return potential, and open a seat at the table with other investors you otherwise would never meet.

Unique Market Insights

From the GPs I have invested in, I receive valuable market updates and insights I wouldn’t otherwise have. Oftentimes this happens through the form of a good quarterly update or via text / phone calls.

Most Emerging Managers build their investment strategy around their unique domain of expertise or zone of genius. This should bear fruit in the insights they can share with their LPs.

Access to Talent

When I was working with a single-family office I often enjoyed the privilege of exploring collaborations with other FOs. Many times family offices were looking for access to top talent bringing innovation to the industries where the FO had their domain expertise.

Investing in Emerging Managers with the mandate of introductions to talent, especially founders, can be a significant pathway to industry insights and learnings.

Impact

For many LPs assessing the impact of a potential investment is a considerable factor in the decision-making process.

There are several different pathways to achieving the desired impact through investing in Emerging Managers. Not only is it in your hands to equip a diverse group of Managers with capital, but in general you are providing capital to the investors in the Venture ecosystem, who live and breathe the same air as the founders shaping our future.

Limited Partners have the responsibility to pick the funds they back wisely. The investors LPs back are those who decide what technological innovation should be funded or not funded.

Emerging Managers can often function as the first institutional capital a founder receives. They can turn the lights on for a startup or may advise some founders to never get going. However, it is the LPs’ capital that is backing the Emerging Managers who are catalyzing the growth of startups impacting the world’s future.